If you’re searching for home giftware wholesalers, you’re likely trying to solve a very practical problem: where to source reliable products that sell, without overcommitting cash or inventory.

For many retailers, especially in the UK and Australia, local wholesalers are the first and most obvious place to start.

But not all wholesalers are created equal. Some are great for testing products and moving fast. Others quietly cap your margins, limit differentiation, and make it hard to scale once demand grows.

This guide is not a sales pitch or a generic list of supplier names. It’s a review-based breakdown of home giftware wholesalers, organized by region, starting with…

UK Home Giftware Wholesalers

The UK has one of the most established home giftware wholesale markets in Europe.

Most suppliers operate as importers and distributors, holding stock locally and reselling to retailers with relatively low MOQs.

This makes UK wholesalers ideal for testing products and getting to market quickly, but less effective for long-term margin growth or exclusivity.

Below are some of the most reputable UK-based home giftware wholesalers, reviewed from a retailer’s point of view.

Gainsborough Giftware

Gainsborough Giftware is a long-established, trade-only wholesaler that has been supplying UK retailers since 1977.

The company operates as a traditional distributor, importing and curating a wide range of home décor and giftware products for resale to independent shops.

It runs both a large physical showroom and a comprehensive online trade portal, allowing retailers to browse and order flexibly.

One of its biggest strengths is its pick-and-mix model, which lets retailers order small quantities across thousands of SKUs.

This makes Gainsborough especially attractive to smaller retailers that want variety without committing to large upfront stock purchases.

Location: Lincolnshire, UK

Product Focus: Home décor and giftware, including ornaments, decorative accessories, seasonal ranges, and licensed gift items.

Best For: Independent gift shops, online gift retailers, and small garden or tourist stores seeking a broad, low-risk product mix.

MOQ:

- No minimum order value

- UK trade account required (VAT registered)

- Free UK delivery on orders over £100

Pros:

- Very broad in-stock range (5,000+ products)

- No MOQ, ideal for testing new lines

- Fast UK dispatch (often 1–2 working days)

- Long-standing trade reputation

Cons:

- Many popular items are widely stocked by other wholesalers

- Limited product exclusivity

- Distributor pricing puts pressure on margins for common designs

Pricing: Pricing follows standard UK distributor models. Because products are non-exclusive, the same SKUs often appear across multiple retailers, increasing price competition.

Hill Interiors

Founded in 1975, Hill Interiors is one of the UK’s largest and most recognisable home décor importers and wholesalers.

Unlike smaller distributors, Hill Interiors focuses heavily on design-led collections, importing and branding its own ranges for the UK trade market.

Its catalog spans everything from furniture and lighting to decorative accessories and artificial florals, giving retailers access to coordinated interior styles.

The company operates multiple showrooms and has a strong presence at UK trade shows, reinforcing its position as a premium wholesale supplier.

Hill Interiors is widely used by retailers aiming to offer a “high-end look” without developing custom products.

Location: Stevenage, UK

Product Focus: On-trend home décor and giftware, including furniture, lighting, textiles, faux greenery, and decorative accents.

Best For: High-end boutiques, interior design studios, and larger gift retailers focused on curated, design-forward interiors.

MOQ:

- £500 minimum opening order (ex VAT)

- £200 minimum on repeat orders

- UK trade account required

Pros:

- Extensive, design-led catalog

- Strong visual merchandising and showroom support

- Established logistics and reliable stock holding

- Recognisable in-house collections

Cons:

- High opening MOQ excludes very small retailers

- Designs are often seasonal and widely replicated

- Premium positioning does not always mean premium margins

Pricing: Wholesale pricing reflects UK import and branding costs. Many designs reappear across the market, and pricing typically sits 30–50% above factory-level sourcing.

Widdop & Co

Widdop & Co is a family-owned UK wholesaler with roots going back to 1883, making it one of the oldest giftware suppliers in the country.

Over time, it has evolved into a large-scale importer and distributor with a catalog of around 13,000 products.

The company combines licensed brands with its own in-house ranges, such as Sanctuary by Hestia, giving retailers access to both branded recognition and exclusive-looking collections.

Widdop operates multiple UK showrooms and maintains a strong design and product development team. Its size and longevity make it a staple supplier for many established gift retailers.

Location: UK

Product Focus: Giftware and home décor, including ornaments, candles, drinkware, seasonal décor, and licensed novelty items.

Best For: Independent gift shops, department stores, garden centres, and souvenir retailers needing depth and variety.

MOQ:

- £500 opening order

- No minimum on subsequent orders

- Free UK delivery over ~£199

Pros:

- One of the largest giftware catalogs in the UK

- Mix of licensed and in-house brands

- Strong trade infrastructure and support

- Flexible ordering after initial commitment

Cons:

- High first-order requirement

- Many best-selling items are generic across the market

- Licensing fees reduce margin flexibility

Pricing: Prices include branding and licensing premiums. Popular ranges are widely stocked, limiting exclusivity and pricing power.

Something Different Wholesale

Something Different Wholesale is a UK-based giftware distributor that has carved out a strong niche in novelty, alternative, and pop-culture products since launching in 1999.

The company is particularly known for its in-house design capability, with the majority of its product range developed internally rather than sourced purely from third-party brands.

It operates a modern online trade platform with rapid dispatch, making it popular with small and online-first retailers.

Product ranges are refreshed frequently to align with trends, seasons, and licensed themes. This makes the supplier highly agile, though less suited to timeless or luxury retail concepts.

Location: Wales, UK

Product Focus: Trend-driven gifts including novelty décor, home fragrance, wall art, seasonal items, and licensed pop-culture products.

Best For: Independent gift shops and online retailers targeting younger or alternative audiences.

MOQ:

- No minimum order value

- Free UK delivery over £75

Pros:

- Extremely low barrier to entry

- Fast dispatch and frequent new designs

- Distinctive novelty-led product mix

Cons:

- Narrow appeal outside novelty-focused stores

- Trend-driven products can saturate quickly

- No customization or exclusivity

Pricing: Wholesale pricing is generally accessible, but wide availability across online sellers often limits retail margins.

Nemesis Now

Nemesis Now is a specialist UK wholesaler founded in 2003, focused almost entirely on licensed fantasy, gothic, and pop-culture giftware.

Rather than acting as a general distributor, the company develops and licenses its own product lines, which are then sold exclusively to trade customers.

Nemesis Now exports globally and maintains strong relationships with major entertainment licensors.

Its products are highly recognisable and appeal to a dedicated fan base, particularly within alternative retail niches.

However, this specialisation also means retailers are competing within a relatively tight and well-defined market.

Location: UK

Product Focus: Licensed collectibles, fantasy figurines, gothic décor, and horror or sci-fi themed home accessories.

Best For: Pop-culture gift shops, comic stores, festival retailers, and Halloween-focused outlets.

MOQ:

- £250 opening order

- £100 minimum on repeat orders

- Trade account required

Pros:

- Strong brand recognition

- Licensed designs not easily replaced by generics

- Regular new product launches

Cons:

- Higher wholesale prices due to licensing

- Many retailers stock the same core lines

- Narrow thematic appeal

Pricing: License fees cap retail margin growth, and popular lines are widely distributed within the niche.

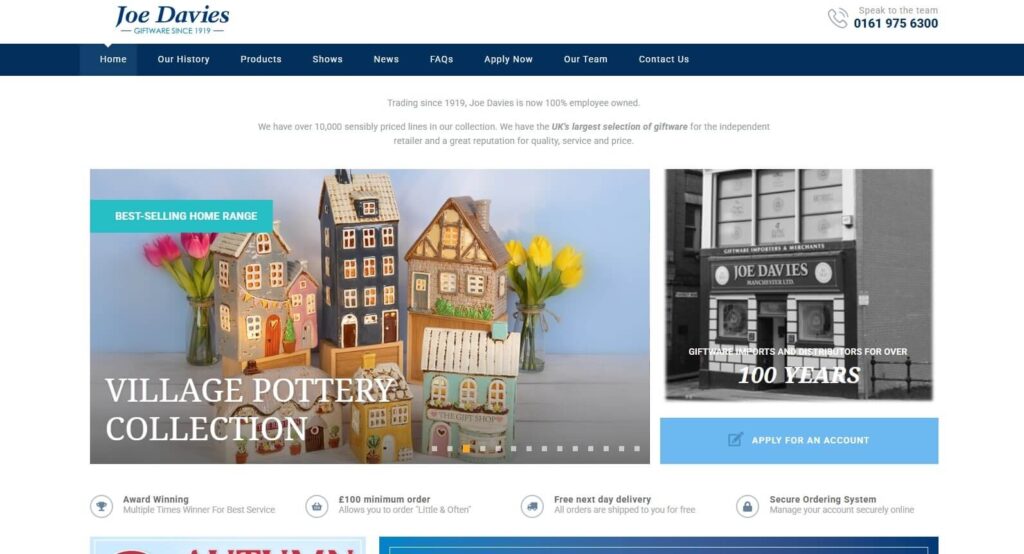

Joe Davies

Joe Davies is a long-standing, employee-owned UK giftware wholesaler established in 1919.

The company has built its reputation on supplying independent retailers with a huge, practical assortment of everyday gift products.

With around 10,000 SKUs available, Joe Davies functions as a one-stop supplier for many small shops.

Its business model focuses on convenience, frequent restocking, and low order thresholds rather than exclusivity or design innovation.

As a result, it is deeply embedded in the UK independent retail ecosystem.

Location: Staffordshire, UK

Product Focus: Mass-market giftware including ornaments, frames, candles, novelty items, textiles, and licensed accessories.

Best For: Local independent gift shops and convenience retailers needing frequent, small restocks.

MOQ:

- £100 minimum order

- Free next-day delivery over £150

Pros:

- Very low entry barrier

- Extremely broad product selection

- Reliable logistics and service

Cons:

- Products are widely available across the UK

- No customization or exclusivity

- Margins require careful pricing discipline

Pricing: Prices target the budget-to-mid segment. Comparable products are easily sourced elsewhere, keeping margins modest.

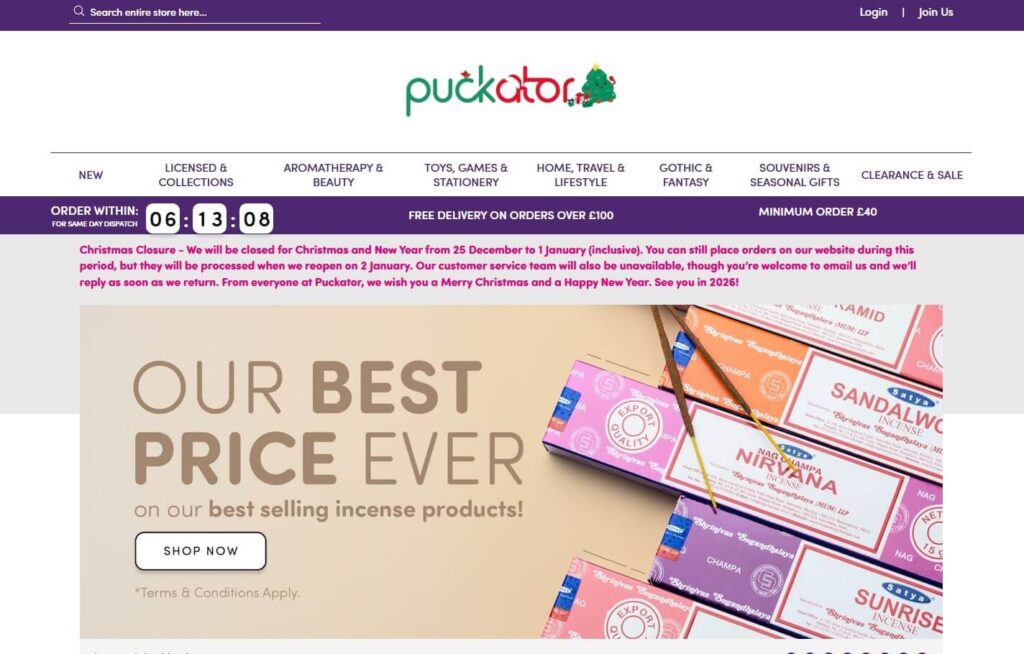

Puckator

Puckator is a well-known UK giftware wholesaler with more than three decades of experience supplying retailers across Europe and beyond.

The company specialises in high-volume, trend-driven giftware and souvenirs, particularly for tourist-heavy retail environments.

Puckator maintains large UK warehouses and refreshes its catalog frequently, allowing retailers to react quickly to seasonal demand.

Its product strategy prioritises breadth and availability over exclusivity. This makes it a dependable supplier for volume-based retail models.

Location: Cornwall, UK

Product Focus: Home décor, novelty gifts, souvenirs, licensed products, eco-friendly items, and seasonal displays.

Best For: Tourist shops, garden centres, and retailers selling themed or impulse-buy merchandise.

MOQ:

- £40 minimum order

- Free UK delivery over £100

Pros:

- Very wide, frequently updated catalog

- Strong logistics and international reach

- Established trade infrastructure

Cons:

- Commodity-style products dominate the range

- Low exclusivity due to high distribution volume

- Tight margins on generic items

Pricing: Pricing is competitive but volume-driven. Similar products are widely available across the UK wholesale market.

Australia Home Giftware Wholesalers

Australia’s home giftware wholesale market is smaller than the UK’s but highly developed, with most suppliers operating as importers and national distributors.

Australian wholesalers are often relied on for their local stock availability, trend awareness, and flexible ordering.

However, because many suppliers source from similar overseas factories, product overlap and pricing pressure are common, especially as retailers scale.

Below are some of the most established Australian home giftware wholesalers, reviewed from a retailer’s perspective.

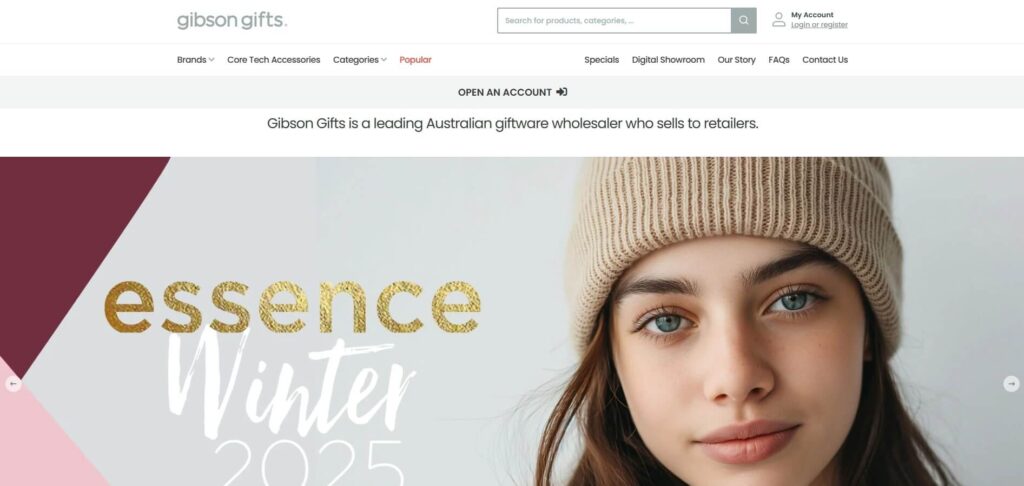

Gibson Gifts

Gibson Gifts is one of Australia’s most established giftware wholesalers, with more than 60 years of experience supplying independent retailers nationwide.

The company operates as a large-scale distributor, importing and curating thousands of gift and home décor products for resale to trade customers.

Its range is deliberately broad, allowing retailers to source novelty items, classic giftware, and home accessories from a single supplier.

Gibson maintains a strong national presence through dedicated sales representatives and local warehousing.

This makes it a dependable supplier for retailers prioritizing convenience and consistency over exclusivity.

Location: Brisbane, Australia

Product Focus: Gift novelty, ceramics, kitchen décor, fashion accessories, jewellery, general home décor, Australian-themed souvenirs, and eco-friendly gift items.

Best For: Independent gift shops, garden centres, home décor boutiques, and e-commerce sellers looking for a wide, low-risk product mix.

MOQ:

- Trade account required (ABN)

- No strict minimum order (pick-and-mix model)

- Free freight on higher-value orders (terms vary)

- Credit accounts available

Pros:

- Very broad catalog (4,000+ items)

- Decades of distribution experience

- Strong national sales and logistics coverage

- Mix of domestic and imported gift brands

Cons:

- Significant product overlap with other Australian wholesalers

- Limited exclusivity across core ranges

- Many souvenir and décor lines already heavily price-competitive

Pricing: Gibson’s pricing reflects standard Australian wholesale margins. Many lines are commonly stocked across the gift trade, keeping effective retail margins in the ~30–50% range.

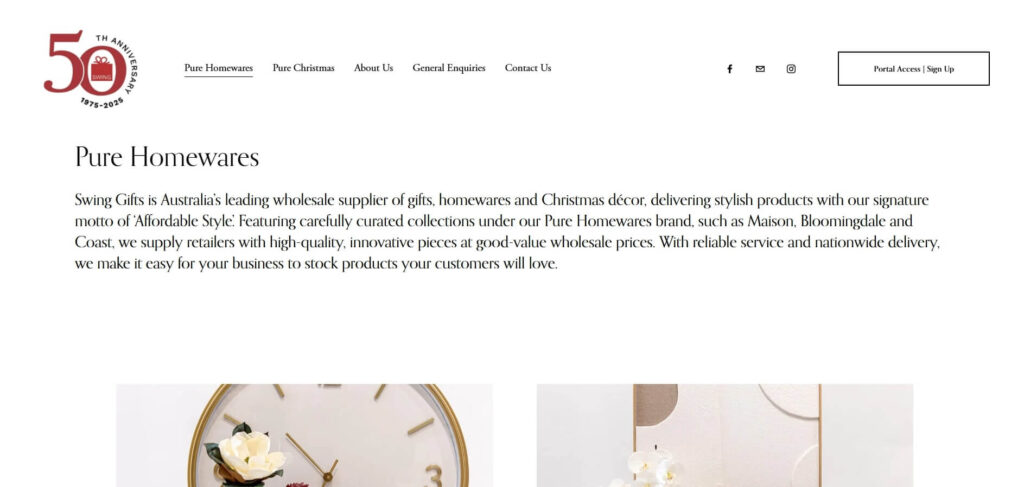

Swing Gifts

Founded in 1990, Swing Gifts is a major Australian wholesaler specializing in trend-led home décor and seasonal giftware.

The company has built its reputation around curated collections inspired by popular interior styles such as Hamptons, coastal, and modern farmhouse.

Swing Gifts places a strong emphasis on visual merchandising, offering retailers professionally styled collections that are easy to display and sell.

Seasonal ranges, particularly Christmas décor, form a major part of its business. As a result, Swing Gifts is often used by retailers seeking fast-moving, on-trend products rather than long-term exclusivity.

Location: Victoria, Australia

Product Focus: Home décor and gifts including planters, vases, wall art, candles, accent furniture, plush toys, and extensive Christmas décor.

Best For: Lifestyle boutiques, mid- to high-end gift shops, department stores, and seasonal or pop-up retailers.

MOQ:

- Wholesale account required

- No publicly stated minimum order

- Online ordering and showroom access

- Freight calculated per order or via flat-rate programs

Pros:

- Strong trend awareness and seasonal appeal

- Boutique-style product presentation

- Merchandising and catalogue support

- Reliable supply for peak retail seasons

Cons:

- Trend-based designs are widely adopted by competitors

- Seasonal focus creates off-season inventory risk

- Margins can be tight on popular décor items

Pricing: Pricing is structured for mass-market retail, with many décor items retailing at around 2× wholesale cost. Trend replication across the market limits long-term differentiation.

WANT Home + Gift

Established in 1990, WANT Home + Gift is a well-known Australian distributor focused on stylish home décor and furniture accessories.

The company imports and distributes exclusive collections designed to deliver a “designer look” at accessible price points.

WANT supplies both gift retailers and furniture stores, positioning itself between mass-market wholesalers and premium interior brands.

Its product strategy emphasizes cohesive styling across furniture, décor, and accessories.

This makes WANT especially attractive to retailers building a curated homewares identity without developing private-label products.

Location: Victoria, Australia

Product Focus: Home décor, furniture accents, wall décor, soft furnishings, glassware, faux plants, and coastal or luxury-inspired collections.

Best For: Home décor boutiques, interior design showrooms, and mid-market homeware retailers.

MOQ:

- Retail trade account required

- No explicit minimum order

- Freight incentives on larger orders

- Early-order and seasonal booking programs available

Pros:

- Design-forward collections with strong visual identity

- Regularly refreshed ranges

- Good merchandising and marketing support

- Suitable for both décor and furniture retailers

Cons:

- Products are not truly exclusive due to wide distribution

- Mid-to-high wholesale pricing pressures margins for smaller stores

- Popular categories (e.g., faux plants) are easily replicated

Pricing: WANT’s pricing reflects its design-led positioning. Comparable styles can often be found elsewhere in the Australian market, making styling and merchandising critical for margin protection.

Darlin

Darlin is a family-run Australian wholesaler known for its focus on handcrafted, ethical, and sustainably produced homeware.

Unlike mass-market distributors, Darlin emphasizes small-batch production and Australian-led design.

The company works closely with makers and artisans, offering products that feel distinctly handmade rather than factory-produced.

Its “Wholesaler with Heart” positioning resonates strongly with values-driven retailers.

Darlin operates on a more relationship-based wholesale model, prioritizing quality and story over scale.

Location: Melbourne, Australia

Product Focus: Artisan home décor and giftware including wooden serving ware, hand-crafted ornaments, textiles, and eco-conscious décor items.

Best For: High-end boutiques, country gift shops, homeware galleries, and eco-conscious retailers.

MOQ:

- No fixed minimum order

- Initial prepayment required

- 14-day terms available after first order

- Optional 3-month style exclusivity for committed retailers

Pros:

- Highly unique, handcrafted product ranges

- Strong ethical and sustainability story

- Limited exclusivity options protect smaller retailers

- Personal, responsive customer service

Cons:

- Limited production capacity and slower replenishment

- Higher unit costs due to handmade nature

- Styles may not suit all retail concepts

Pricing: Pricing is higher than mass-market giftware. While perceived value supports premium retail pricing, margins can tighten if similar styles enter the market.

Pilbeam Living

Pilbeam Living is a heritage Australian giftware wholesaler with over 50 years of industry experience.

The company is best known for its own branded lifestyle ranges, including Pilbeam Living, Pilbeam Kids, and Petit by Pilbeam.

Rather than acting as a general distributor, Pilbeam focuses on cohesive, design-led collections across home décor, gifts, and children’s products.

Its products are widely distributed across Australia and New Zealand, including specialty retail, travel retail, and cultural institutions.

Pilbeam’s strength lies in brand consistency rather than broad product volume.

Location: Victoria, Australia

Product Focus: Luxury candles, designer glassware, children’s bedding and gifts, plush toys, accent furniture, and contemporary home décor.

Best For: Designer homeware boutiques, baby and kids specialty stores, premium gift shops, and museum or airport retailers.

MOQ:

- Trade account required

- No widely published minimum order

- Active sales representative network

- Regular participation in trade fairs

Pros:

- Strong in-house brand identity

- Consistent design aesthetic across categories

- High service standards and reliability

- Recognised name in premium gift retail

Cons:

- Premium pricing limits mass-market appeal

- Many retailers stock the same core ranges

- Merchandising is critical to stand out

Pricing: Pilbeam’s wholesale prices are higher than discount-focused wholesalers. Retailers often operate on tighter margins (around 20–30%), requiring careful pricing and positioning.

China-Based Home Giftware Wholesalers / Manufacturers

Unlike UK and Australian wholesalers, China-based suppliers typically operate as export manufacturers or large trading companies, selling directly from factories rather than reselling imported stock.

This model comes with lower base costs, higher MOQs, longer lead times, and greater customization potential.

For growing retailers, these suppliers represent the next step after local wholesalers, particularly when margins, branding, and exclusivity start to matter more than convenience.

Below are representative examples of export-oriented Chinese manufacturers commonly used by international giftware importers.

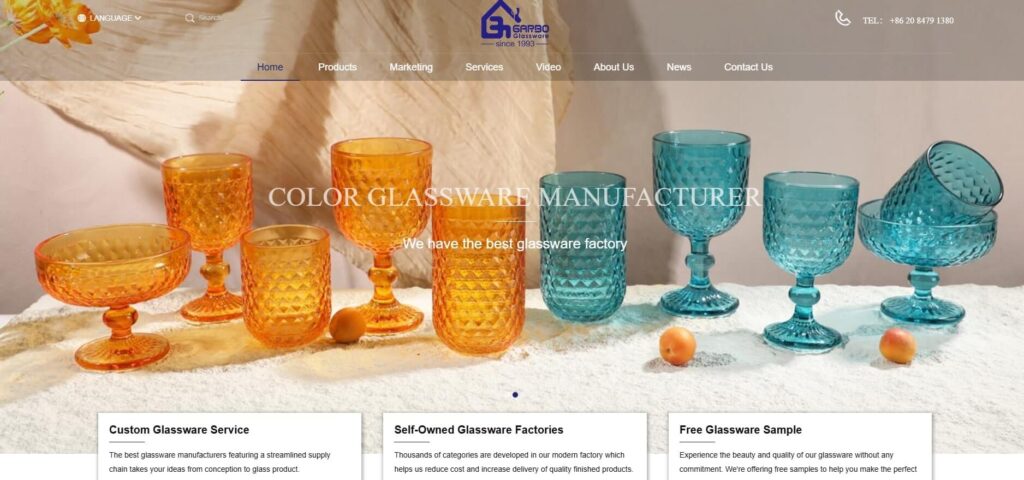

Guangdong Garbo Industrial Co., Ltd.

Established in 1993, Guangdong Garbo Industrial is a large-scale glassware manufacturer and export trading group serving global homeware markets.

Unlike traditional wholesalers, Garbo owns and operates its own glass factories alongside extensive warehousing facilities totaling over 60,000 square meters.

The company focuses heavily on export markets, supplying distributors, importers, and retail chains across Europe, Australia, and North America.

Its scale allows it to maintain massive ready-stock inventories while also supporting OEM and private-label production.

Garbo is a typical example of a factory-first supplier that underpins many Western “local” wholesalers.

Location: Guangdong, China

Product Focus: Glass tableware and décor, including drinkware sets, bowls, vases, candle holders, and borosilicate cookware. Also acts as an OEM supplier for international glassware brands.

Best For: Importers, homeware chains, and distributors placing large-volume orders who need factory-level pricing. Not suitable for very small or first-time retailers.

MOQ:

- Typical MOQs start at 500+ pieces per SKU (often negotiable for first orders)

- Container shipping (FOB / CIF)

- Full or staged prepayment required (T/T)

Pros:

- Very low ex-factory pricing due to in-house production

- Extremely broad product range with ready-stock availability

- OEM customization options (logos, colors, packaging)

- Scale supports consistent supply for large orders

Cons:

- High MOQs and long lead times (often 2–3 months including shipping)

- No retailer-friendly credit terms

- Designs are generally generic unless custom tooling is paid for

- Requires hands-on quality control and supplier management

Pricing: Garbo’s factory prices are often a fraction of UK or Australian wholesale prices. This gap highlights the 30–50% (or more) markup added by local distributors, though retailers must commit to higher inventory volumes to access these savings.

Xiamen Wonderful Import & Export Co., Ltd.

Xiamen Wonderful Import & Export is a private Chinese manufacturer established in 2006, specializing in decorative and seasonal giftware for Western markets.

The company focuses heavily on holiday-driven product categories, supplying Christmas, Halloween, Easter, and themed décor to international buyers.

It maintains a showroom presence and regularly exhibits at major trade fairs such as Canton Fair and Christmasworld Frankfurt.

Its business model centers on producing ready-made seasonal designs at scale for overseas distributors.

As with many Chinese exporters, it operates primarily behind the scenes rather than as a consumer-facing brand.

Product Focus: Ceramic and polyresin décor, including holiday ornaments, garden statues, decorative figurines, and seasonal tabletop décor.

Best For:Retailers and importers sourcing large volumes of seasonal merchandise, such as garden centres, novelty stores, and holiday décor specialists.

MOQ:

- Typical MOQs around 500 pieces per item (often negotiable)

- EXW or FOB shipping terms

- Worldwide export coverage; samples available

Pros:

- Large library of ready-made seasonal designs

- Strong experience supplying EU and North American markets

- Competitive factory pricing

- Willing to offer basic OEM customization

Cons:

- Highly seasonal product focus limits year-round sales

- Designs are easily replicated by other factories

- Freight costs spike during peak holiday shipping seasons

- Inventory risk if trends change late in the season

Pricing: Even after freight, per-unit costs are often 50–70% lower than comparable UK or Australian wholesale prices. This explains why many Western wholesalers source holiday décor from factories like this.

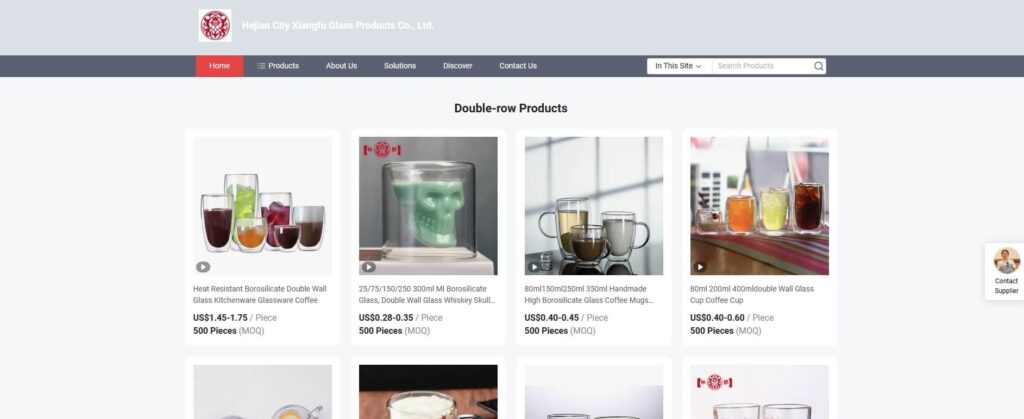

Xi’an HFU Glass Co., Ltd.

Xi’an HFU Glass is a Chinese glassware exporter with more than a decade of experience supplying international markets.

The company owns its own glass production facilities and focuses on meeting Western regulatory standards, including FDA and LFGB compliance.

HFU specializes in functional and decorative glass items commonly sold as home gifts or tableware.

It operates primarily as an OEM supplier, producing for overseas brands, distributors, and importers.

Like many factory exporters, it prioritizes volume efficiency over design exclusivity.

Product Focus: Glass giftware and housewares, including wine glasses, tumblers, vases, candle holders, lanterns, and carafes.

Best For: Kitchenware retailers, tableware brands, garden centres, and souvenir shops sourcing branded or bulk glass items.

MOQ:

- Typical MOQs between 500–1,000 pieces per SKU

- Container shipping preferred

- Payment terms usually 30% deposit / 70% before shipment

Pros:

- Factory-direct pricing on compliant glass products\

- Wide selection of standard glassware designs

- Custom branding and packaging available at volume

- Experience supplying EU and UK markets

Cons:

- High MOQs and upfront payment requirements

- Limited design differentiation without custom molds

- Glass freight costs can be significant

- Requires active quality inspection and logistics oversight

Pricing: HFU’s pricing often sits 40–60% below UK wholesaler rates for comparable glassware. This price gap reflects the added layers of distribution, branding, and warehousing built into local wholesale pricing.

Local home giftware wholesalers play an important role, especially when you are starting out. They offer low MOQs, fast delivery, and minimal operational complexity.

But as we analyzed suppliers across the UK, Australia, and beyond, a consistent pattern emerged: the convenience of local wholesalers comes with a hidden long-term cost.

This cost rarely shows up on the invoice, but it shows up in your margins, pricing power, and ability to scale.

1. Built-In Markups You Can’t Negotiate Away

Most local wholesalers operate as importers and distributors, not manufacturers. By the time a product reaches your store, it has typically passed through multiple layers:

Factory → Exporter → Importer → Local distributor → Retailer

Each layer adds its own margin. In practice, this often means 30–50% markup over factory pricing, even before marketing, rent, or staffing costs are considered. While wholesalers sometimes offer volume discounts, the underlying pricing structure remains largely fixed.

For small orders, this trade-off makes sense. For growing retailers, it quietly caps profitability.

2. Product Saturation Becomes Inevitable

When a product sells well, wholesalers don’t protect it—they scale it. Successful SKUs are pushed to more retailers, across more regions, as quickly as possible.

The result:

- Multiple stores carrying the same décor items

- Identical products appearing across online marketplaces

- Price competition that erodes perceived value

What initially feels like a “safe bestseller” often becomes a race to the bottom once saturation sets in.

3. You’re Paying for Distribution, Not Differentiation

Local wholesalers add value through stock holding, logistics, and convenience, not through product exclusivity. Very few offer territory protection, design ownership, or meaningful customization.

In other words, you are paying a premium for:

- Warehousing

- Domestic freight

- Sales reps and showrooms

Not for a product that only your store can sell.

4. Scaling Exposes the Margin Ceiling

At low volume, wholesaler pricing feels manageable. As volume grows, the math changes. Reordering the same products at the same price while marketing and operating costs rise puts pressure on margins.

This is where many retailers hit an invisible ceiling:

- Prices can’t increase without losing competitiveness

- Costs don’t decrease because sourcing hasn’t changed

- Growth requires more effort for diminishing returns

The problem isn’t demand, it’s the sourcing structure.

Local Wholesaler vs China Sourcing Agent

Once retailers understand the hidden costs of local wholesalers, the next logical step is comparing their current sourcing model with a factory-direct approach via a China sourcing agent.

The difference is not just price, it’s control, scalability, and long-term strategy.

Here’s how the two models compare in real terms.

| Factor | Local Wholesaler | China Sourcing Agent |

| Pricing | Includes importer and distributor markups | Factory-direct pricing |

| MOQ | Low (often no MOQ) | Higher, but negotiable with planning |

| Product Exclusivity | Very limited or none | High (custom designs, private label) |

| Customization | Rare or not offered | Core part of the model |

| Lead Time | Fast (days) | Longer (production + shipping) |

| Inventory Risk | Low per order | Higher, but more predictable at scale |

| Margin Potential | Capped | Expands as volume grows |

| Supplier Relationship | Transactional | Strategic, long-term |

| Scalability | Limited | Designed for growth |

Who Each Model Is Actually Best For

Local Wholesalers Make Sense If:

- You are just starting out

- You want to test categories with minimal upfront risk

- Speed matters more than margin

China Sourcing Agents Make Sense If:

- You have proven demand

- You want better margins or private-label control

- You plan to scale beyond a single store or region

Where NicheSources Fits In

NicheSources operates between these two worlds. We help retailers transition from buying finished products off a wholesaler’s shelf to sourcing directly from vetted Chinese factories, without having to manage suppliers, language barriers, or quality checks themselves.

This isn’t about replacing local wholesalers overnight but more about knowing when the old model starts holding your business back.

How to Choose the Best Home Giftware Supplier for Your Shop

There is no single “best” home giftware supplier, only the best option for your current stage of business. The right sourcing model depends on volume, risk tolerance, brand goals, and how far you plan to scale.

Here’s a simple way to decide.

If You’re Just Starting Out

If you’re opening a shop, testing online sales, or experimenting with new categories, local wholesalers are usually the right choice.

They make sense because they:

- Allow low or no MOQs

- Offer fast delivery and easy reordering

- Reduce cash flow and inventory risk

At this stage, speed and flexibility matter more than margin. The goal is learning what sells, not maximizing profit on every unit.

If You’re Running a Stable, Growing Store

Once you’ve identified bestsellers and are reordering the same products consistently, the limitations of local wholesalers start to show.

This is where you should:

- Audit which SKUs you reorder most often

- Calculate how much margin is lost to distributor pricing

- Identify products that could benefit from light customization

Many retailers at this stage use a hybrid approach, continuing to buy some items locally while exploring direct sourcing for top performers.

If You Want Better Margins or Brand Control

If margin pressure is increasing or you want to build a recognizable brand, sourcing strategy becomes critical.

A China sourcing agent is often the better fit if you:

- Need private label or branded packaging

- Want to differentiate beyond price

- Plan to scale volume across multiple channels

This shift is less about cutting costs and more about owning your product, not just reselling it.

If You’re Scaling Across Multiple Locations or Channels

For retailers expanding into wholesale, marketplaces, or multiple stores, consistency and cost control become non-negotiable.

At this stage, supplier selection should prioritize:

- Stable factory relationships

- Predictable pricing at scale

- Quality control and compliance

Local wholesalers rarely support this level of growth efficiently, as pricing and availability remain fixed regardless of volume.

Final Thoughts

Local home giftware wholesalers are a smart place to begin. They lower the barrier to entry, reduce early risk, and help you understand what actually sells in your market.

For many retailers, they are the fastest way to get products on shelves and start generating cash flow.

But as this guide shows, they are rarely the best long-term solution.

Once you start reordering the same products, competing on price, or feeling margin pressure, the issue is no longer demand, it’s structure.

Paying distributor markups, selling widely available products, and relying on shared catalogs eventually limits how far your business can grow.

If you’re at the stage where local wholesalers are starting to feel restrictive, NicheSources can help you transition.

Whether you’re exploring direct sourcing for the first time or ready to scale beyond wholesale catalogs, we’ll help you build a sourcing setup that actually supports growth.

Request a sourcing quote and see what your products really cost at the factory level.