When you’re a foreign buyer sourcing your products cross-border, you need to familiarize the different international payment methods available.

This will give you the power to make an informed decision when you need to pay the exporter and negotiate favorable terms and conditions.

When calculating your eCommerce profit margins, things like shipping Incoterms and international payment methods really matter. They will have a large impact on your end product price and the profit margin you can achieve.

So, let’s dive right in and see the five most commonly used methods of payment in international trade!

Key Takeaways

- International payment methods vary in speed, cost, and security.

- Digital platforms offer convenient alternatives to traditional bank transfers.

- Understanding currency exchange rates and fees is essential for cost-effective transactions.

5 Best Methods of Payment in Foreign Trade

When engaging in international trade, choosing the right payment method is crucial. Several options offer security and convenience for both buyers and sellers:

1. Cash-In-Advance

Cash-in-advance is a secure payment method where buyers pay the full amount before receiving goods or services. It’s commonly used in high-risk international transactions and new business relationships.

Cash-in-advance offers sellers maximum protection in international trade. It’s prevalent in industries dealing with high-value goods like luxury items, specialized machinery, and custom-made products.

This method gained popularity during the 2008 financial crisis when trust between businesses was low.

In regions with unstable economies or strict currency controls, cash-in-advance is often the preferred choice. China, for example, saw a 15% increase in cash-in-advance transactions for exports in 2020.

Some of the most commonly used cash-in-advance methods are:

- Wire transfers

- Credit or debit cards

- Escrow services

- Payment by check

Wire Transfers

Wire transfer is by far the most widely used cash-in-advance payment method for wholesale and bulk orders. It’s very quick and convenient. Don’t be confused – a wire transfer is the same as a T/T payment.

In short, the seller gives his bank routing information to the buyer, such as:

- The receiving bank’s name and address

- The seller’s name and address

- SWIFT address

- ABA number

- Bank account title

- Account number

With these details, the buyer completes the payment in advance, before the exporter ships the goods.

Naturally, there’s a fee that banks will charge for processing SWIFT transactions. This fee can be covered by the buyer, the seller, or split between both parties. It’s a matter of agreement.

Credit Cards or Debit Cards

The next common cash-in-advance payment method in international trade are credit and debit cards. They grew a lot in popularity in recent years due to their convenience and ease of use.

However, they’re more suitable for smaller transactions due to the high fees they charge.

Additionally, credit card transactions are placed online, exposing sellers to the risk of non-payment and even fraudulent activities.

Exporters that sell online to buyers should set up verification processes and precautions to avoid fraud and scams.

Escrow Service

With the spread of the Internet, escrow services became the new favorite in international trade. Escrow is a third-party service that will mediate between the buyer and the seller.

Here’s how that works:

- Step 1 – the buyer puts money in “escrow”.

- Step 2 – the seller confirms the money is there, and ships the goods.

- Step 3 – the buyer receives the goods and is given time to inspect them.

- Step 4 – the buyer confirms receiving the goods in a satisfactory condition, and the escrow money is released to the seller.

In the case of cross-border trade, escrow services are usually banks or other trustworthy companies.

Note that these escrow services will also have an escrow fee. Typically, this fee can be covered by the buyer, or seller, or split equally between both parties.

In any case, escrow is a great way to add an extra layer of security to cash-in-advance payments.

Check Payment

Payment by check is by far the least popular method of cash-in-advance payments, even with exporters. The reasons are numerous:

- Exporters often don’t cash in the checks before shipment, resulting in bouncing checks and non-payment.

- A lengthy process that might take several weeks to collect.

- The collection process is even more complicated and lengthy for foreign currency checks.

All in all, this complexity and length make check payments obsolete, especially for cash-in-advance international trade payments.

Pros

- Eliminates credit risk for the seller

- Provides immediate access to funds

- Simplifies accounting processes

- Reduces the need for credit checks

- Ideal for one-time or infrequent transactions

- Suitable for high-risk markets or new business relationships

Cons

- May deter potential buyers

- Reduces competitiveness in the market

- Ties up buyer’s capital

- Risk of non-delivery for the buyer

- Potential currency exchange rate fluctuations

- Limited recourse for buyers if goods are unsatisfactory

Transaction Cost

The cost of cash-in-advance transactions varies depending on the method used.

Wire transfers typically cost $25-$50 per transaction, with some banks charging additional fees for international transfers. Credit card payments incur processing fees of 2-4% of the total amount.

Escrow services usually charge 0.89% to 3.99% of the transaction value, depending on the deal size.

Remember to factor in potential currency conversion fees, which can range from 1-3% of the transaction amount. Some online payment platforms offer lower fees for high-volume traders, potentially reducing costs to 1.5-2% per transaction.

2. Letters of Credit (L/C)

Letters of Credit provide a secure payment method in international trade, balancing risks for both buyers and sellers. They involve banks acting as intermediaries to guarantee payment upon fulfilling specified conditions.

Letters of Credit (L/C) are widely used in industries with high-value transactions, such as commodity trading and manufacturing.

Banks issue L/Cs on behalf of buyers, promising to pay sellers when specific documents are presented. This method is especially popular in regions with uncertain political or economic conditions.

L/Cs have evolved since their inception in ancient times. Today, they’re used in about 13% of global trade transactions. Modern L/Cs benefit from electronic document processing, reducing paperwork and speeding up transactions.

Major international banks like HSBC and Citibank offer specialized L/C services. Fintech companies are also entering this space, introducing blockchain-based L/Cs to enhance security and efficiency.

Here is how an L/C works:

- Step 1 – the buyer (importer) instructs his bank to pay an agreed amount to the seller’s bank.

- Step 2 – the buyer’s bank sends a Letter of Credit to the seller’s bank as proof of sufficient and legit funds.

- Step 3 – the seller meets all the terms and conditions and ships the goods.

- Step 4 – payment is released once all terms and conditions are met.

As you can see, Letters of Credit offer both the buyer and the seller a certain degree of protection for cross-border payments. So, an L/C is a great trade finance tool, and it’s one of the most secure methods of payment for both parties – the seller and the buyer.

In fact, compared to the other international payment methods on this list, Letters of Credit have mostly advantages for both parties, especially in terms of payment safety.

Pros

- Provides payment security for sellers

- Offers financing options for buyers

- Helps mitigate country and political risks

- Enables transactions with unfamiliar partners

- Allows for customizable terms and conditions

- Can be used as a tool for negotiation in trade deals

Cons

- Complex documentation requirements

- Can be expensive due to bank fees

- Time-consuming process

- Strict compliance checks may lead to payment delays

- Potential for discrepancies in documents

- Less flexible than some modern payment methods

Transaction Cost

L/C costs vary based on the transaction value, issuing bank, and complexity of the deal. Typically, you can expect to pay 0.25% to 1.5% of the L/C value as fees.

Additional charges may include amendment fees ($50-$150), document handling fees ($150-$250), and confirmation fees (0.1%-0.5% of L/C value).

Some banks offer volume discounts for frequent users. For example, a $100,000 L/C might cost around $1,000-$2,000 in total fees. Always negotiate with your bank for the best rates, especially for regular international transactions.

3. Documentary Collections (D/C)

Documentary collections offer a balanced approach to international trade payments. This method involves banks acting as intermediaries to facilitate the exchange of documents and payments between exporters and importers.

Documentary collections work by having the exporter’s bank send shipping documents to the importer’s bank. The importer’s bank then releases these documents to the buyer once payment is made or a Bill of Exchange is accepted.

This method is commonly used in industries dealing with commodities and merchandise exports.

Documentary collections are particularly popular in established trade relationships where trust exists between parties. They’re often employed in regions with stable economic conditions but where letter of credit costs are deemed too high.

Recent technological advancements have streamlined the process, making it faster and more efficient. Many international banks now offer digital platforms for managing documentary collections, reducing paperwork and processing times.

There are two options:

- Document against payment (DAP) – the importer pays the face amount at sight.

- Document against acceptance (DA) – the importer pays on a date specified in the draft.

So, the export documents, including the transfer of title, are released in exchange for payment in both cases.

Although documentary collections are a more affordable way of payment, they don’t offer the same level of security, especially for sellers.

Pros

- Lower cost compared to letters of credit

- Faster processing than open account transactions

- Provides more security than open accounts

- Easier to set up than letters of credit

- Allows for negotiation of payment terms

- Banks handle document verification

Cons

- Less secure than letters of credit

- No guarantee of payment for the exporter

- Importer can refuse to pay upon document arrival

- Relies heavily on trust between trading partners

- Limited recourse if buyer defaults on payment

- Potential for document discrepancies causing delays

Transaction Cost

The cost of a documentary collection typically ranges from 0.1% to 0.5% of the transaction value. You’ll usually encounter a flat fee of $50 to $150 for processing. Some banks may charge additional fees for document handling or amendments.

These costs are generally split between the exporter and importer, but this can be negotiated. Remember, while documentary collections are often cheaper than letters of credit, they may be more expensive than simple wire transfers.

Always check with your bank for their specific fee structure, as it can vary depending on the complexity of the transaction and the countries involved.

4. Open Account Terms (O/A)

Open Account Terms (O/A), also known as Accounts Payable, is a payment method where exporters ship goods before receiving payment.

This approach offers flexibility but carries risks. Importers typically pay within 30, 60, or 90 days after receiving the goods.

Open Account Terms are widely used in international trade, especially among established business partners. This method is common in industries with high competition and low profit margins. In 2023, 60% of global B2B transactions used O/A terms.

Due to established trade relationships, European and North American companies frequently employ this method. O/A terms have evolved with digital platforms, allowing for easier tracking and management of payments.

Many multinational corporations prefer O/A for its simplicity. For example, Walmart often uses this method with its long-term suppliers.

Pros

- Improves cash flow for importers

- Enhances competitiveness in global markets

- Strengthens business relationships

- Simplifies payment processes

- Reduces transaction costs

- Allows for bulk ordering and economies of scale

- Enables faster shipment of goods

- Provides flexibility in payment timing

Cons

- High risk of non-payment for exporters

- Potential for cash flow problems for sellers

- Limited recourse if buyer defaults

- Currency fluctuation risks

- Possible strain on business relationships if payments are late

- Lack of payment guarantee

- Increased need for credit checks and risk assessment

- Potential for fraud or misrepresentation

Transaction Cost

Open Account Terms typically involve lower transaction costs than other international payment methods.

You’ll generally pay only standard bank transfer fees, ranging from $10 to $50 per transaction. Some banks may charge a percentage of the transfer amount, usually 0.1% to 1%.

For recurring transactions, you might negotiate lower fees with your bank. Remember, while direct costs are low, you should factor in potential costs of credit checks and insurance to mitigate risks.

Currency conversion fees may apply if you’re dealing in different currencies. These can add 1-3% to your transaction costs.

5. Consignment Payment Method

Consignment payments offer a unique approach to international trade, balancing risk between buyers and sellers. This method allows importers to receive goods without immediate payment, while exporters maintain ownership until the products are sold.

The consignment payment method involves exporters shipping goods to importers without receiving payment upfront. You retain ownership of the merchandise until it’s sold to end customers.

This approach is particularly popular in industries with high-value or perishable goods, such as art, luxury items, and fresh produce.

Consignment has gained traction in recent years, especially in emerging markets. E-commerce platforms like Amazon and eBay have embraced this model, allowing smaller businesses to reach global audiences without significant upfront costs.

Historically, consignment was used primarily for local transactions. However, improved logistics and digital tracking systems have made it viable for international trade. Today, about 5% of global trade transactions use consignment payments.

Pros

- Low risk for importers as they only pay after selling the goods

- Opportunity to test new products in foreign markets

- Increased cash flow for importers

- Potential for higher sales volumes

- Access to a wider range of products for importers

- Flexibility in pricing and inventory management

Cons

- Higher risk for exporters as payment is not guaranteed

- Delayed payment can impact cash flow for exporters

- Potential for disputes over unsold or damaged goods

- Requires trust and strong relationship between parties

- Complex accounting and inventory tracking

- Limited control over product pricing and marketing

Transaction Cost

Consignment payment methods typically involve lower upfront costs compared to other international payment options.

However, you’ll generally encounter fees for shipping, insurance, and customs clearance, which can range from 2% to 5% of the shipment value.

Storage fees may apply if goods remain unsold for extended periods. Commission rates for consignment sales usually fall between 20-40% of the final sale price, depending on the industry and agreement terms.

Some consignment platforms charge listing fees, often around $0.20-$0.35 per item. Payment processing fees for final transactions typically range from 2.5-3.5% plus a fixed fee of $0.15-$0.30 per sale.

FAQs about International Payment Methods

Choosing the right international payment method involves considering safety, fees, and business-specific needs. Let’s explore these key aspects to help you make informed decisions for your global transactions.

What Is the Safest International Payment Method?

The safest method of payment for sellers or exporters is cash-in-advance since they’re receiving the payment before shipping the goods. On the other hand, the safest method for importers or buyers is consignment or open account terms.

What Is the Best Way to Avoid International Transaction Fees?

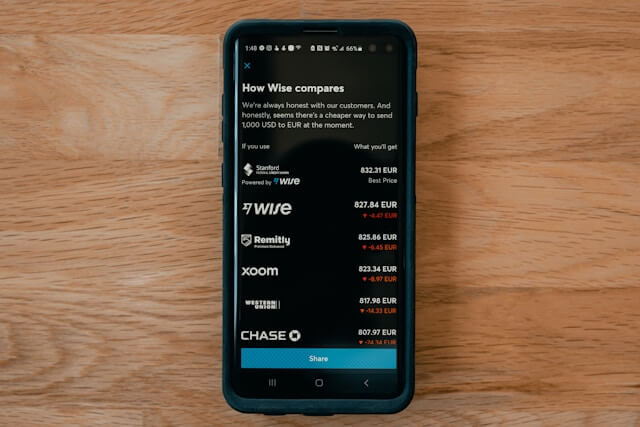

You can minimize fees by choosing payment methods designed for international transactions. Multi-currency accounts allow you to hold and exchange multiple currencies, often at better rates than traditional banks.

Some online payment platforms offer competitive fees for international transfers. Compare options to find those with low or no fees for your specific transaction types.

What Should I Consider When Choosing a Payment Method for International Trade?

Transaction speed is crucial for many businesses. Consider methods that offer quick settlement times to improve cash flow.

Evaluate the total cost, including exchange rates and hidden fees. Some methods may have lower upfront fees but less favorable exchange rates.

Compatibility with your existing systems is important. Choose a method that integrates well with your accounting software and banking setup.

Consider the preferences of your international partners. Some regions may favor certain payment methods over others.

Conclusion: Choosing the Right International Payment Methods for Your Business

International payments are essential in our interconnected world. You now have a clear picture of various methods available, from traditional wire transfers to modern digital wallets.

Choosing the right payment method depends on your specific needs. Consider factors like speed, cost, and security when making your decision.

Ready to expand your business globally? Don’t let payment complexities hold you back. Get a free quote from us at NicheSources to explore tailored sourcing solutions that fit your international payment needs.

Take the next step in your global journey. With the right payment methods and sourcing partner, you’ll be well-equipped to thrive in the international marketplace.