When sourcing goods from China, you will likely encounter suppliers that accept different modes of payment terms. The options often include payment through debit/credit cards, Western Union, and t/t payments, among many others.

While most other forms of payment are well-understood, t/t payments often confuse buyers. This is followed by questions such as: How do they work? Is it safe to use them? When is it ideal to use T/T payments?

So, in today’s guide, we explain T/T payments in detail including their risks, pros, cons, as well as some valuable tips on how to use them safely.

Read on.

What Is a T/T Payment?

T/T is an abbreviation for ‘Telegraphic Transfer’. It is a mode of payment where funds are transferred from one person’s account to another through their respective banks.

In essence, if you need to transfer money to Mr. T’s account, you would instruct your bank to do so on your behalf. The transfer then proceeds as follows:

- Your bank deducts the money from your account.

- Pays it to Mr.T’s bank through an interbank payment system.

- Mr. T’s bank receives the money and credits it into his account.

In the past, banks had no universal system of communication or money transfer. They, therefore, used telegraphs to communicate and handle these types of payments. Hence the name, telegraphic transfer.

However, in 1973, the SWIFT system was created. Banks thus moved on from using telegraphs and began using this system as it was better optimized for financial transactions.

Further, after the rise of the internet, the advancement of T/T payments came full circle. They are now faster than they were before and fully automated through a harmonized system.

Some jurisdictions now also refer to them as bank transfers or wire transfers because telegraphs have since become obsolete.

What Are the Benefits of T/T Payments?

T/T payments offer unique benefits that other payment methods may not. Let’s take a look at some of them.

International Money Transfers

T/T payments allow you to send money across the globe in just a few short steps. Moreover, T/T payments accommodate almost all currencies.

This makes it easier to source products and safely pay for them without ever having to leave your country.

Safe Transfers

Banks require precise details of both the sender and the recipient before initiating any transfers. They also provide a confirmation, for each transfer, that you can use as proof of payment.

Further, the SWIFT system allows banks to keep track of transfers and resolve any issues if they arise. It is far more reliable than the previous telegraph system.

High Transfer Limits

T/T payments allow transfers of high amounts of money. Subsequently, you can conveniently pay for wholesale orders in one go as opposed to a series of small payments that may only complicate matters.

The exact limit may, however, vary between banks and depending on the laws in your country.

Efficiency

Today, T/T payments take about 1 to 4 days to go through. This efficiency prevents delays in trade because most suppliers only initiate production or the shipping of goods after receiving payment.

Additionally, quick international transfers, prevent transactions from being drastically impacted by fluctuations in foreign exchange. As a result, recipients of T/T payments receive adequate funds even after the conversion of the money into their local currency.

What Are the Risks or Disadvantages of T/T Payments?

If you choose to use T/T payments, it would be prudent to be wary of the following risks and downsides.

Sensitivity to Errors

T/T payments are executed based on precise banking details. A transaction may, therefore, fail to go through if you make an error when entering your details or that of the recipient.

Admittedly, this is a great security feature but it can cause major delays. More so if you have to wait for the money to be reversed to your account so that you can initiate a fresh transaction.

Deductible Fees

Both your bank and the recipient’s bank charge fees for executing T/T payments. So, if you would like to pay out $2,500, the recipient will likely receive a lesser amount because both banks will deduct their fees.

The major downside here is that if this happens, you would still owe the recipient and may have to make another payment and incur fees all over again.

Scams

T/T payments can be convenient for scammers because they can simply provide a personal account number when requesting payment for goods or services.

This makes it very difficult to seek redress because it is harder to seek accountability from an individual than from a company. T/T payments also go through in a short time, unlike escrow transactions that remain pending until your goods are delivered.

Misplaced Payments

Occasionally, one bank can transfer funds to another and the transaction fails to go through. This is usually a system error and not due to any mistakes made by you or your bank.

Unfortunately, while you may share details confirming the transaction, the recipient and their bank may have no record of it because it may not reflect on their end.

One or both of the banks involved may have to initiate an investigation to resolve the matter. Sadly, these issues are not always resolved instantaneously and could stall your purchase for quite a while.

How to Reduce Your Risk When Using T/T Payments

Now that you are aware of the risks of T/T payments, let us discuss how to mitigate them.

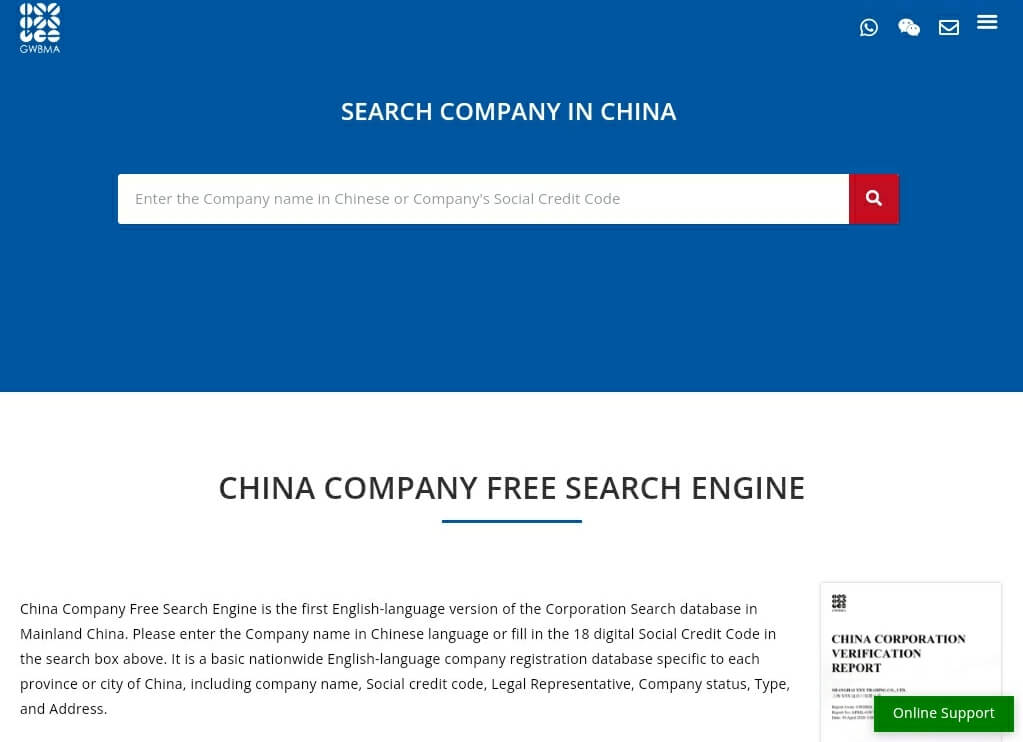

Do Your Due Diligence

It is crucial to always vet the suppliers if you plan to buy goods from China. You can do this by looking up their business registration details to ensure that they are valid and that their licenses are up to date.

Further, decline requests to send money to personal accounts. This may save you from getting scammed by individuals that only collect money and never deliver any goods.

Tip: In most cases, you may be able to differentiate between a personal account and a business account based on the account name. The business account name should also match the name indicated on their business registration.

Pay Attention to the Bank Location

If a supplier’s business is registered in Guangdong but their bank is in Hong Kong or overseas, tread with caution. It may be a ploy to get you to transfer money to an offshore account where you will have no course of redress.

Confirm the Details You Provide

Most banks now facilitate transfers through apps and internet banking. Some, however, still require you to physically show up and apply for the transfer.

Regardless of the approach, always take time to cross-check the details you have entered into the transfer form. Avoiding errors will equally help you avoid delays or botched payments.

Discuss Fees with Your Supplier

Banks allow the senders and recipients of T/T payments to specify how transaction fees will be handled between them. This can be done in any of the following ways.

- The buyer pays – in this scenario, you (the buyer) would cater for both the fees charged by your bank and those charged by the recipient’s (your supplier) bank. It is indicated as ‘OUR’ on the transfer documents.

- The supplier pays – here the seller bears the transaction fees charged by the buyer’s bank and their bank. It is indicated as ‘BEN’ on the transfer documents.

- The transaction fees are shared – in this case, the buyer incurs the transaction fees charged by their bank and the seller incurs the fees charged by their bank. It is indicated as ‘SHA’ on transfer documents.

Note: The second way means that a buyer can transfer just the exact amount needed to pay for their goods because they do not have to worry about fees.

How to Make a Telegraphic Transfer to China

Making a telegraphic transfer to China is a quick and easy process when you know what to expect and how to navigate it. So, here is a step-by-step guide to get you through your T/T transactions.

Talk to Your Bank

Reach out to your bank and inquire about their requirements for T/T transactions. Create a list based on their feedback so that you can refer to it as you prepare the necessary details and documents.

Some banks carry out vetting processes too before authorizing your application to make T/T payments. It is thus a good idea to contact your bank early enough in your sourcing process so that there is enough time to handle such issues.

Discuss the Terms of Payment with Your Supplier

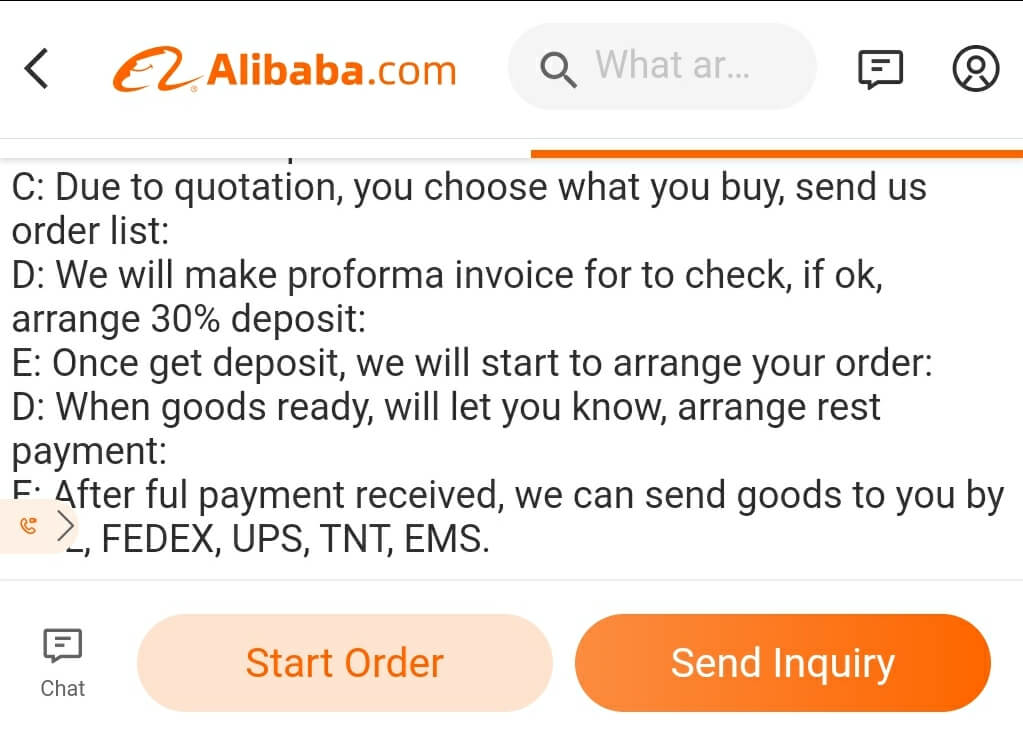

Different suppliers impose different payment terms. Some require full payment upfront while others may only request a deposit and a final payment at a deferred date. Have this discussion early enough so that you have ample time to prepare the required amount.

When payment is due, notify your supplier that you would like to pay them via a telegraphic transfer. This will let them know what payment details to indicate in the pro forma invoice. This would also be the right time to discuss which of you will pay the transaction fees.

Initiate the Transaction

Visit your bank or access it online to initiate the transfer. In both approaches, you will need to fill out a form indicating:

- The date of the transfer

- The seller’s bank details

- The amount to be paid out (remember to make allowances for the fees)

- Whether the transfer is foreign or domestic

- The currency to be used in the transaction

- The reason for the payment

Be sure to fill in every mandatory bit of information and attach any additional documents that your bank requires. Finally, look through the information to confirm the details then submit your application.

The Transfer

Your bank will initiate the transfer by instructing your supplier’s bank to pay X amount to your supplier. This is communicated via SWIFT.

Your bank then transfers the money to your supplier’s bank to complete the transaction.

How Long Does a T/T Payment to China Take?

A T/T payment to China can, on average, take 2 to 5 days. However, this may vary due to factors such as:

Time Zone Differences

Take, for example, that your country is in a time zone 8 hours behind China time.

It means that if you initiate a transfer at 10 a.m. local time, it will already be 6 p.m. in China. The instructions will thus be conveyed to the bank in China the next day, at the earliest.

Public Holidays

Banks observe public holidays very strictly. So, if you initiate a T/T payment on a day when the receiving or intermediary banks are observing a public holiday, the transaction will remain pending until they resume.

Bank Schedules

Banks have to perform reconciliations at the end of every business day. They, therefore, have different cut-off times for receiving and making transfers.

If your transaction request comes in late in the day, you may have to wait until the next day for it to be processed.

The Payment Process

It can take a day or more for the receiving bank to verify the details provided by your bank for a transfer. There is also no way to fast-track this process because it is done carefully to avoid fraud.

In addition, if the banks involved in the transfer have no working relationship, they may have to use an intermediary bank. This creates an extra step in the payment process and may prolong the timelines.

How Much Does It Cost to Make a T/T Payment to China?

The cost of making a T/T payment is usually about $50 or less. It varies based on:

- Your location

- Whether you will be catering for the bank fees owed to both banks

It is equally important to consider the exchange rate margin that may arise during the transfer. It is a cost that you may have to cover so that your supplier receives the full agreed amount. This margin is based on prevailing forex rates and the amount being transacted.

Tips on How to Make T/T Payments to China

Fill in the Details Correctly

Fill in your supplier’s business name in English as indicated in the proforma invoice, not in Chinese characters. Reach out to them and ask for clarification if no English name is provided.

If the name happens to be longer than the field provided, complete it in the next field. This is vital because providing a partial name will not suffice. Even references such as ‘LTD.’ (if indicated by the supplier) are necessary.

Time Your Transfers

Take note of public holidays in your country and China. This may help prevent transfer delays.

Maintain Some Leverage

Besides verifying a supplier’s authenticity and their banking details, try to maintain some leverage in the transaction.

For example, if you are paying a manufacturer, it may be best to first pay 30% of the total cost so that they can begin production. This will give them some incentive to complete your order and receive the pending 70%.

If the goods are ready to ship, consider negotiating for FOB shipping terms. This would allow you to pay part of the money upfront and clear the rest once the goods are on board.

Have a Purchase Agreement

A purchase agreement is a legally binding document that you can use to seek compensation if you pay a supplier and they fail to deliver. It should outline:

- The type of goods involved in the purchase

- The cost of the goods

- The agreed product specifications

- Turnaround times

- The terms of payment

- Shipping terms

- The terms of redress if either party fails to fulfill their role in the agreement

Which Payment Terms Do Chinese Suppliers Use?

Chinese suppliers often request payment under one of the following terms:

- Installments – your supplier may require you to pay a specific percentage of the total cost before production and pay off the rest once the goods are ready for shipping.

- Advance payment – payment for the goods must be completed before they are dispatched for shipping. In rare cases, this may also be requested before manufacturing.

- Payment within 30 days – this term stipulates that you have to pay the manufacturer within 30 after they complete production.

- Payment on sight/ Cash Against Documents – this term requires you to pay the supplier after they hand over the goods to the shipping carrier and obtain the requisite documents. You (the buyer) would only get the shipping documents after paying the seller.

How to Negotiate Better Payment Terms with Chinese Suppliers

The buying and selling of goods is a mutually beneficial agreement. As such, you always have room to negotiate payment terms that work for both you and your supplier. Make an effort to:

Choose a Suitable Supplier

Aim for a supplier that is customer-friendly and willing to accommodate your needs. They may not bend to every request you make but they will be a much better choice than a rigid supplier solely driven by their profits.

Have Clear Goals

It will be much easier to work on a compromise with your supplier if you have clear goals. So, analyze your requirements and your budget then come up with proposals to present to your supplier.

Be Fair

A good agreement should be fair to both parties and not in favor of one. Consider this as you explore various payment options and explain to your supplier how your proposals can benefit both of you.

FAQs about T/T Payments

Is a Telegraphic Transfer the Same as a Bank Transfer?

Yes, it is.

The name ‘telegraphic transfer’ simply remained in use in some regions while others embraced synonyms like bank transfer or wire transfer when the telegraph became obsolete.

Should You Make a T/T Payment in Your Local Currency or Chinese Yuan?

It is advisable to make T/T payments in the Chinese Yuan. It is generally cheaper and more convenient than using your local currency which will eventually still have to need to be converted into Yuan.

If using the Chinese Yuan is not possible, consider widely-used currencies like the US dollar or the Euro. Such currencies are more accessible globally and their exchange rates are competitive.

Should You Make a T/T Payment to a Chinese Supplier’s Private Account?

No.

Scammer suppliers in China are known to request payments to their private accounts. It is thus difficult to distinguish whether you are paying a legitimate supplier or a con artist when you use a personal account.

Can You Use a T/T Payment When Importing from Alibaba? Is It Safe?

Yes, you can buy goods from Alibaba using a T/T payment as long as the Alibaba supplier accepts T/T payments.

T/T payments to Alibaba are as safe as transactions to any other supplier in China. Nevertheless, strive to use the tips we have outlined above to avoid scammers and unfair payment terms.

Can You Ask for a Refund after a T/T Payment to China?

Yes, you can.

If the payment has not gone through to the receiving bank, you can ask your bank to cancel it.

However, if the supplier has already reached your supplier, reach out to them and request your refund. It is best to do this before your order is shipped because most suppliers may be unwilling to agree to such a refund unless they are at fault.

Final Thoughts

T/T payments are a good solution for paying suppliers overseas within a reasonably short time. Moreover, they are widely accepted by most suppliers and their risks are manageable.

However, we, at NicheSources, can help you source and pay for products more confidently. We scrutinize every supplier extensively, perform inspections on your behalf, and ensure that you only pay for goods that meet all your specifications.

Reach out to us with your sourcing requests and request a free quote to get started.