Imagine making secure payments with just a tap of your smartphone. That’s the promise of Alipay, a mobile payment platform used by over a billion people. But is it truly safe?

Short answer: Yes! Alipay employs advanced encryption, real-time risk monitoring, and buyer protection to safeguard your transactions and personal data.

These security measures have helped establish Alipay as a trusted payment method for millions of users worldwide.

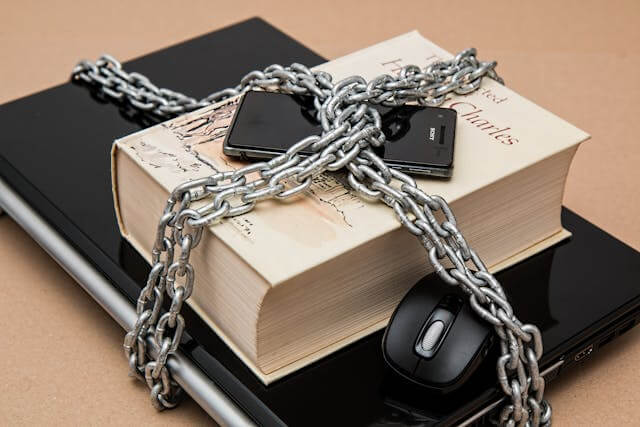

However, despite its robust security features, Alipay isn’t without risks. As with any digital payment system, it’s crucial to stay vigilant and follow best practices to protect yourself from potential scams or fraud.

Come along as we discuss how the Alipay system works, its features, and how to use it safely.

Key Takeaways

- Alipay uses encryption and real-time monitoring to protect user data and transactions.

- Users should exercise caution and follow security best practices when using the platform.

- Alipay offers both advantages and limitations compared to other payment methods.

What Is Alipay?

Alipay is a versatile mobile payment platform developed by Ant Financial, a subsidiary of the Chinese tech giant Alibaba Group. It’s more than just a digital wallet – it’s a comprehensive financial ecosystem.

You can use Alipay for various transactions, including online purchases, in-store payments, and money transfers. The app allows you to store your debit or credit card details securely, making payments quick and convenient.

Alipay boasts an impressive user base of over 1 billion active users worldwide. In China alone, it processes a staggering 200 million transactions daily.

Alipay offers several features beyond simple payments. You can pay bills, book travel tickets, hail taxis, and even invest in mutual funds through the app. It’s like having a financial Swiss Army knife in your pocket.

For international users, Alipay provides a solution for payments in China without needing a local bank account. This feature makes it particularly useful for tourists and business travelers.

Alipay’s reach extends beyond China’s borders. It’s accepted by millions of merchants across 56 countries and regions, making it a valuable tool for global transactions.

What Makes Alipay Safe?

Alipay employs robust security measures to protect users’ financial information and transactions. The platform utilizes advanced encryption, real-time monitoring, and multi-factor authentication to ensure a safe payment experience.

Is Alipay Safe and Legitimate?

Alipay is a legitimate and secure payment platform developed by Ant Group, a subsidiary of Alibaba. It’s regulated by Chinese financial authorities and has gained global recognition for its safety standards.

Alipay uses 128-bit encryption to protect user data and transactions. This level of encryption is considered highly secure in the financial industry. The platform also employs real-time fraud detection systems to identify and prevent suspicious activities.

To enhance security, Alipay offers biometric login options such as facial recognition and fingerprint identification. These features add an extra layer of protection to your account.

Alipay’s stringent fund supervision system, implemented in partnership with financial institutions, further safeguards your money. This system ensures that your funds are properly managed and protected.

Is Alipay Safe for Foreigners?

Alipay has expanded its services to cater to international users, making it a viable option for tourists and expats in China and other countries where it’s accepted. The platform offers an English interface, making it user-friendly for non-Chinese speakers.

When using Alipay abroad, you benefit from the same security features available to domestic users. These include encrypted transactions, fraud detection, and multi-factor authentication.

For added security, Alipay implements device binding. This feature links your account to specific devices, reducing the risk of unauthorized access from unknown devices.

It’s important to note that while Alipay is widely accepted in China, its usage may be limited in other countries. Always check the availability and acceptance of Alipay at your destination before relying on it as your primary payment method.

How to Avoid Alipay Scams

Protecting your Alipay account from scams is crucial for safe digital transactions. By following these key strategies, you can significantly reduce the risk of falling victim to fraudulent activities.

Use Official Alipay Channels

Always download the Alipay app from trusted sources. The official Alipay website is the safest place to get the app. Avoid third-party app stores or unfamiliar websites.

Check the app’s authenticity before installation. Look for the correct developer name (Ant Financial Services Group) and verify the app’s ratings and reviews.

Be wary of copycat apps. These may look similar to the real Alipay but can steal your information. Double-check the app icon and name before entering any personal details.

When accessing Alipay on a computer, type the URL directly into your browser. Don’t click on links in emails or messages claiming to be from Alipay.

Enable Two-Factor Authentication

Turn on two-factor authentication (2FA) for an extra layer of security. This feature requires a second form of verification besides your password when logging in.

To enable 2FA:

- Go to your Alipay account settings.

- Look for the security or privacy section.

- Find the two-factor authentication option and turn it on.

Choose a reliable 2FA method. SMS verification is common, but authenticator apps like Google Authenticator offer higher security.

Set up backup 2FA options. This ensures you can still access your account if your primary 2FA method is unavailable.

Be Cautious with Suspicious Links

Avoid clicking on links in unsolicited emails, text messages, or social media posts claiming to be from Alipay. These often lead to phishing sites designed to steal your login information.

Hover over links to see the actual URL before clicking. If it doesn’t match the official Alipay domain, don’t click it.

Be skeptical of messages urging immediate action. Scammers often create a false sense of urgency to trick you into making hasty decisions.

If you’re unsure about a link, go directly to the Alipay app or website by typing the URL yourself. This ensures you’re on the legitimate site.

Watch out for shortened URLs. These can hide the true destination and lead you to malicious sites.

Verify Payment Requests

Always double-check payment requests before confirming. Scammers may pose as legitimate sellers or service providers to trick you into sending money.

Use Alipay’s built-in verification features. The app often provides seller ratings and transaction history to help you assess legitimacy.

Be wary of deals that seem too good to be true. Unusually low prices or exclusive offers are common tactics used by scammers.

For large transactions, consider using Alipay’s escrow service. This holds your payment until you confirm receipt of goods or services, providing an extra layer of protection.

If a seller pressures you to pay outside of Alipay, it’s likely a scam. Stick to the platform’s official payment methods.

Regularly Monitor Your Account

Check your Alipay account regularly for any suspicious activity. Set up transaction notifications to receive alerts for all account activities.

Review your transaction history frequently. Look for any unfamiliar charges or transfers, no matter how small.

Keep your account information up to date. This includes your phone number and email address, which are used for security notifications.

If you notice any suspicious activity, report it to Alipay immediately. The sooner you alert them, the better chance of resolving the issue.

Consider setting up spending limits on your account. This can help minimize potential losses if your account is compromised.

Advantages and Disadvantages of Using Alipay

Alipay offers a range of features that can enhance your digital payment experience, but it’s important to consider both its strengths and limitations. Let’s explore the key benefits and potential drawbacks of using this popular payment platform.

Advantages of Using Alipay

- Wide acceptance in China: You can use Alipay at millions of merchants across China, making it incredibly convenient for shopping and dining.

- Quick transactions: Payments are processed instantly, saving you time at checkout.

- Advanced security: Alipay uses encryption and two-factor authentication to protect your financial information.

- Multiple payment options: You can link credit cards, debit cards, and bank accounts to your Alipay wallet.

- Additional services: Alipay offers bill payments, money transfers, and even investments all within the app.

- Safer than cash: Using Alipay reduces the need to carry large amounts of cash, especially when traveling.

Disadvantages of Using Alipay

- Limited international acceptance: While popular in China, Alipay may not be widely accepted in other countries.

- Potential for employee fraud: Internal risks can be harder to prevent than external security breaches.

- Language barriers: The app may not be fully translated, causing difficulties for non-Chinese speakers.

- Fees for certain transactions: International transfers and some services may incur additional costs.

- Privacy concerns: As with any digital payment system, your transaction data is stored and potentially shared.

- Dependency on technology: You’ll need a smartphone and internet connection to use Alipay, which may not always be available.

How Does Alipay Work?

Alipay functions as a digital wallet and standalone payment method. You can link your bank accounts, credit cards, and other payment methods to your Alipay account for easy access.

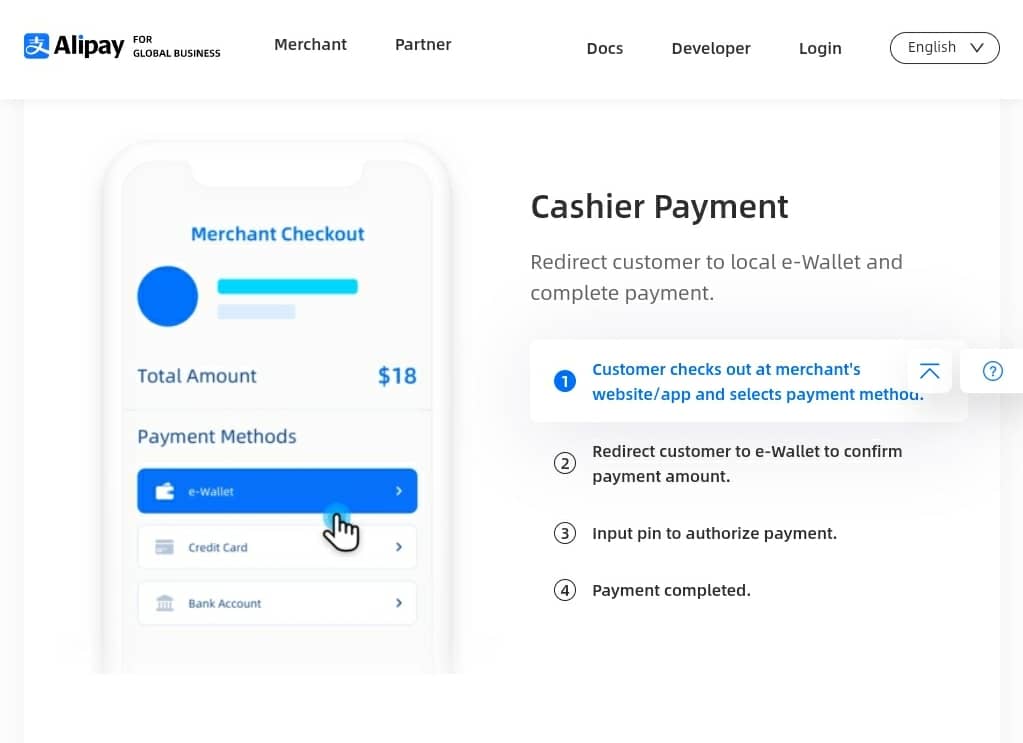

When shopping online, you can select Alipay as your payment option at checkout. The app will prompt you to confirm the transaction, ensuring secure and quick payments.

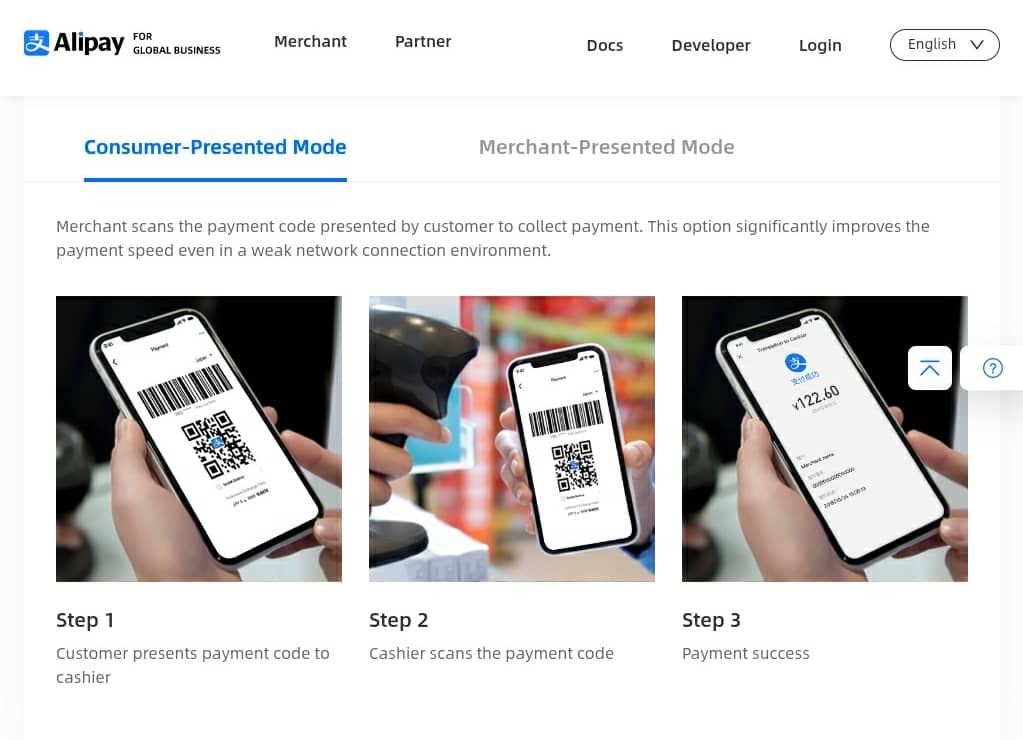

For in-store purchases, Alipay offers a convenient QR code scanning feature. You can either scan the merchant’s QR code or have them scan yours to complete the transaction.

Alipay isn’t just for shopping. You can also use it to transfer money to friends and family. Simply enter the recipient’s Alipay account or phone number, specify the amount, and send it instantly.

Managing your funds is easy with Alipay. You can check your balance, view transaction history, and even set up automatic payments for bills.

The app also offers additional services like investing, booking travel, and paying for utilities. This makes Alipay a versatile tool for managing various aspects of your financial life.

With over 1 billion users worldwide, Alipay has become a popular choice for both consumers and merchants. Its seamless integration with various platforms makes it a convenient option for all your payment needs.

How to Set Up an Alipay Account

Setting up an Alipay account is a straightforward process that involves downloading the app, registering your details, and verifying your identity. You’ll need to follow several steps to ensure your account is secure and ready for use.

Step 1: Download the Alipay App

Visit your device’s app store and search for “Alipay”. The app is available for both Android and Apple devices. Look for the official Alipay app developed by Ant Financial Services Group. Tap the “Download” or “Install” button to begin the installation process.

Once the app is downloaded, open it on your device. You’ll see the Alipay logo and a welcome screen.

Step 2: Select Your Language Preference

After opening the app, you’ll be prompted to choose your preferred language. Alipay supports multiple languages, including English. Select your language from the available options.

This step ensures you can navigate the app comfortably in your preferred language. You can always change this setting later in the app’s preferences if needed.

Step 3: Register with Your Phone Number

To create your account, you’ll need to provide a valid phone number. Tap on the “Register” or “Sign Up” button on the app’s home screen. Enter your phone number, including the country code.

Make sure the number you enter is active and accessible, as you’ll need it for verification in the next step.

Step 4: Enter the Verification Code

After entering your phone number, Alipay will send a verification code via SMS to the number you provided. Check your messages and enter the code in the app when prompted.

This step helps verify that you have access to the phone number you’ve registered with. If you don’t receive the code within a few minutes, there’s usually an option to resend it.

Step 5: Create a Password

Next, you’ll need to create a strong password for your Alipay account. Choose a password that’s at least 8 characters long and includes a mix of uppercase and lowercase letters, numbers, and special characters.

Avoid using easily guessable information like birthdays or common words. This password will be used to log into your account, so make sure it’s secure and memorable.

Step 6: Provide Personal Information

Alipay will ask for some basic personal information to complete your profile. This typically includes your full name, date of birth, and nationality. Enter your details accurately as they appear on your official identification documents.

Providing correct information is crucial for account verification and to comply with financial regulations.

Step 7: Link a Bank Account or Credit Card

To use Alipay for transactions, you’ll need to link a payment method. Tap on “Add Bank Card” or a similar option in the app. You can add a bank account or credit card.

Enter your card details carefully. Alipay may make a small test transaction to verify the card. This process ensures your payment method is valid and ready for use.

Step 8: Verify Your Identity

For security purposes and to comply with regulations, Alipay requires identity verification. You’ll need to provide a valid form of ID, such as a passport or national ID card.

Follow the app’s instructions to upload clear photos of your ID. You may also need to take a selfie for facial recognition verification. This step helps prevent fraud and ensures account security.

Step 9: Set Up Payment Password

Create a separate payment password for added security. This is typically a 6-digit PIN that you’ll use to confirm transactions. Choose a PIN that’s different from your login password and other PINs you use.

Remember this PIN, as you’ll need it for every transaction. Avoid using easily guessable numbers like birth dates or sequential digits.

Step 10: Enable Additional Security Features

Alipay offers several security features to protect your account. Enable two-factor authentication for an extra layer of security. You can also set up biometric authentication, such as fingerprint or face recognition, if your device supports it.

These features significantly enhance your account’s security and protect against unauthorized access.

Step 11: Complete the Setup

Once you’ve completed all the previous steps, your Alipay account is ready to use. Take a moment to explore the app’s features and familiarize yourself with its layout.

You can now use Alipay for various transactions, including online payments, in-store purchases, and money transfers. Remember to keep your account information and passwords secure at all times.

How to Pay Using Alipay

Alipay offers multiple convenient payment methods for various situations. You can use it for online shopping, in-store purchases, and transferring money to other users. Let’s explore how to use Alipay for different types of transactions.

Online Shopping

When shopping online, Alipay makes checkout a breeze. First, select Alipay as your payment method on the merchant’s website. You’ll be redirected to the Alipay login page. Enter your account details and confirm the payment amount.

For added security, Alipay may ask you to enter a verification code sent to your registered phone number. Once verified, the transaction is complete. Your purchase is protected by Alipay’s buyer protection policy.

Some websites offer a “Quick Pay” option. This allows you to complete your purchase with just one click after initial setup. It’s faster but requires you to have sufficient funds in your Alipay balance.

In-Store Shopping

Paying with Alipay at physical stores is quick and easy. The most common method is using QR codes. When you’re ready to pay, open the Alipay app and tap the “Pay” button. You’ll see two options:

- “Pay”: Scan the merchant’s QR code

- “Collect”: Show your QR code for the merchant to scan

For “Pay”, simply scan the store’s QR code and enter the amount. Confirm the payment, and you’re done! With “Collect”, the cashier scans your code and processes the payment on their end.

Some stores also support NFC payments. If your phone has NFC, just tap it against the payment terminal. Enter your PIN or use biometric authentication to complete the transaction.

Transferring Funds to Another Alipay Account

Sending money to friends or family via Alipay is straightforward. Open the app and tap “Transfer”. Enter the recipient’s Alipay account or phone number. You can also select them from your contacts if they’re saved.

Next, enter the amount you want to send. Add a message if you’d like – it’s optional but can be helpful for record-keeping. Review the details and confirm the transfer.

Transfers between Alipay accounts are usually instant and free. However, there may be fees for large amounts or transfers to bank accounts. Always check the fee structure before confirming your transfer.

Alipay allows you to set up recurring transfers, perfect for regular payments like rent. You can also split bills easily by requesting money from multiple people in a group chat.

Alipay Transaction Fees

When using Alipay, you might encounter various fees depending on the type of transaction.

For international credit card payments on platforms like Taobao or Tmall, Alipay charges a flat rate of 3% of the transaction amount. This fee applies to physical goods purchases, excluding mobile phone bills.

Good news for small purchases! Alipay waives transaction fees for single transactions under 200 RMB. This can be especially beneficial if you’re making frequent small payments during your travels in China.

For currency conversion, Alipay’s fees are generally competitive. Unlike some other payment platforms, Alipay only charges a transaction fee, not a separate foreign exchange fee. This can potentially save you money on cross-border transactions.

It’s important to note that while Alipay itself may not charge additional fees for using foreign bank cards, your card issuer might. Always check with your bank about potential foreign transaction fees before using your card with Alipay.

Remember, fees can change over time. It’s a good idea to review Alipay’s current fee structure before making significant transactions or when planning to use it extensively during your travels in China.

Frequently Asked Questions

Alipay offers various options for international users and has safety measures in place for financial transactions. Let’s address some common queries about using Alipay, its global acceptance, and security features.

Can I Use Alipay Without a Chinese Bank Account?

Yes, you can use Alipay without a Chinese bank account. Alipay now allows international users to link their foreign credit cards to the app. You can also use the Alipay Tour Pass, which lets you load funds into a prepaid account.

This feature is especially helpful for tourists and short-term visitors to China. The Tour Pass is valid for 90 days and can be topped up multiple times during your stay.

Is Alipay Like PayPal?

The general concepts of Alipay and PayPal are alike. They are both digital payment platforms that are linked to users’ bank accounts and can be used to transfer funds between peers or pay merchants.

Nevertheless, PayPal:

- Is accessible in about 200 countries while Alipay is only available in China as it requires a Chinese bank account to sign up.

- Can facilitate the transfer of funds between the bank accounts of users but Alipay only allows funds to be sent between Alipay accounts.

In contrast, Alipay:

- Is cheaper as it only charges transaction fees and no foreign fees but PayPal charges both.

- Provides fairer user terms as it does not freeze or impose forfeiture on users’ funds like PayPal can, unless there is a security threat or highly suspicious activity.

To put it briefly, PayPal and Alipay are alike but their features differ. It may not be possible to substitute one for the other.

Is Alipay Accepted in the US?

Alipay’s acceptance in the US is growing, but it’s not as widespread as in China. The platform has partnered with several US merchants to cater to Chinese tourists and students.

You can use Alipay at select retailers, restaurants, and tourist attractions in major US cities. However, it’s not a primary payment method for most US-based businesses, so it’s wise to have alternative payment options when traveling.

Is It Safe to Link My Credit Card to Alipay?

Linking your credit card to Alipay is generally safe due to the platform’s robust security measures. Alipay uses advanced encryption technologies to protect your financial information during transactions.

The app also employs real-time risk monitoring and multi-factor authentication to prevent unauthorized access. However, it’s crucial to follow best practices like using a strong password and enabling additional security features provided by the app.

Closing Insights: Answering the Question – Is Alipay Safe?

Alipay stands as a secure and reliable payment platform for your online transactions. With robust encryption and fraud prevention measures, you can trust Alipay to protect your financial data.

Remember these key points:

- Alipay offers strong buyer protection

- It employs real-time risk monitoring

- Only 0.04% of transactions result in fraud

While Alipay excels in security, it’s wise to exercise caution and follow best practices when using any digital payment system.

If you are not able to access Alipay, you do not have to miss out on the joys of safe shopping. We can reliably handle your payments on platforms like Taobao or any other retailer or manufacturer that only accepts Alipay.

To get started, simply send us a brief of the products you require and request a free quote at any time.