Thinking of sourcing furniture from Vietnam in 2026? You’re not alone.

Vietnam has become a global hub for furniture manufacturing – thanks to its skilled craftsmanship, competitive prices, and use of sustainable materials like acacia, rubberwood, and rattan.

Whether you’re a wholesaler, retailer, or building your own brand, Vietnam offers a wide range of factories. Many can handle both large-scale production and custom designs.

In this guide, we’ve handpicked 17 of the most reliable furniture manufacturers in Vietnam.

You’ll find details on their specialties, export experience, and customization options, so you can choose the right supplier with confidence.

| Manufacturer Name | Core Specialty | Target Market | Key Certifications | Best For |

| ScanCom International | Outdoor furniture (teak, aluminum, recycled plastic) | USA, EU | FSC, BSCI, ISO 9001, ISO 14001 | Large retailers needing high-volume, sustainable outdoor collections |

| Interwood Vietnam Co., Ltd. | Indoor wood furniture (bedroom, dining) | USA, UK, EU, Australia | PEFC, BSCI, SMETA | Mid-sized brands needing consistent OEM indoor furniture |

| Q-Furniture | Concrete & concrete-wood furniture | USA, EU, Australia | SGS-tested products | Design-led brands & boutique hospitality projects with low MOQs |

| AA Corporation | Custom hospitality & fit-out furniture | Global (Hotels & Resorts) | ISO 9001, ISO 14001 | Luxury hotels, large-scale bespoke interior projects |

| WOODNET | Indoor & outdoor wood furniture | USA, EU, Japan | FSC (varies by factory) | Buyers seeking mixed indoor/outdoor wood collections |

| FURAKA | Solid wood indoor furniture | USA, EU | FSC, ISO 9001 | Importers sourcing solid wood furniture at scale |

| San Lim Furniture | Outdoor furniture (wood & mixed materials) | USA, EU | FSC, BSCI | Outdoor furniture buyers needing factory-scale reliability |

| An Loc Furniture | Synthetic rattan & wicker furniture | USA, EU | ISO 9001, ISO 14001 | Patio and resort furniture with strong export pricing |

| Artex Nam An | Handcrafted natural-fiber furniture & decor | USA, EU, Japan | BSCI, AZO-free materials | SME brands sourcing eco-friendly, low-MOQ decor & small furniture |

| Thinh Phu Furniture | Outdoor wood furniture (acacia, eucalyptus) | USA, EU | FSC (partial), VCCI, HAWA | Cost-conscious outdoor furniture buyers |

| ATC Furniture | Wicker & outdoor furniture | USA, EU, Hospitality | ISO 9001, ISO 14001 | Hospitality, cafés, and commercial outdoor projects |

| Kaiser 1 Furniture | High-volume indoor furniture (US-style) | USA | FSC, CARB, ASTM compliance | Big-box retailers needing massive, compliant supply |

| Rochdale Spears | Luxury indoor furniture & upholstery | USA, EU | FSC (project-based), internal QC | Premium brands & high-end retail collections |

| Truong Thanh Furniture Corporation | Vertically integrated indoor & office furniture | USA, EU, Asia | FSC, public-company governance | Large distributors & multi-category sourcing |

| Savimex Corporation | Indoor wooden furniture | USA, EU, Japan | FSC, BSCI, ISO 9001 | SMEs needing stable OEM supply without mega-factory MOQs |

| Minh Duong Furniture | Solid wood & veneer furniture | USA, EU, Australia | Export compliance (varies) | Small-to-mid buyers testing new collections |

| Viet Anh Furniture | OEM indoor furniture | USA, EU | Export-ready QC | Growing ecommerce & wholesale brands |

A List of Vietnam Furniture Manufacturers

1. ScanCom International

ScanCom International is a Denmark-founded outdoor furniture manufacturer with large-scale production facilities in Vietnam.

It is widely recognized as one of the world’s leading suppliers of premium outdoor furniture, serving major global retailers and brands.

ScanCom’s Vietnam operations act as its primary manufacturing hub, supporting high-volume export programs across North America, Europe, and other international markets.

The company places strong emphasis on sustainability, material innovation, and long-term manufacturing partnerships.

Its scale, systems, and certifications make it a preferred supplier for buyers seeking consistency at volume rather than small test orders.

Key Features:

- Large-scale, export-focused production for global retailers

- Strong sustainability framework and certified supply chains

- Advanced automation and modern manufacturing processes

- Proven track record with high-volume, repeat programs

Product Range:

- Outdoor dining and lounge furniture

- Patio chairs, tables, sofas, loungers, and benches

- Parasols, cushions, and outdoor accessories

- Materials include teak, eucalyptus, aluminum, synthetic wicker, and recycled plastic

Customization Capabilities:

- OEM and ODM production for private-label collections

- Ability to adapt existing designs to brand specifications

- In-house design and R&D teams supporting seasonal collections

- End-to-end project coordination from prototyping to export

MOQ: ScanCom primarily works with high-volume, container-based orders. Publicly referenced minimums are around 300–350 pieces per order, depending on product type and configuration. While limited trial orders may be discussed in specific cases, ScanCom is best suited for buyers planning consistent, large-scale purchasing.

Lead Times: Typical production lead times range from 8–10 weeks (approximately 55–60 days) for bulk outdoor furniture orders. Repeat orders may be completed slightly faster once designs and materials are established.

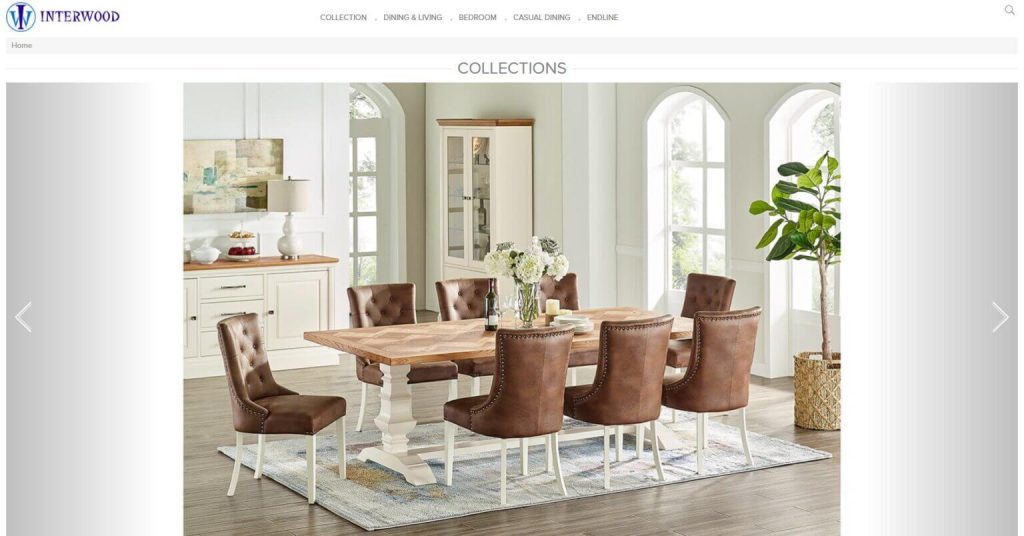

2. Interwood Vietnam Co., Ltd.

Interwood Vietnam is an indoor furniture manufacturer with international roots, operating as part of the UK-based Interwood Group.

The company runs a modern manufacturing facility in Binh Duong and focuses on producing high-quality wooden furniture for residential interiors.

With decades of experience, Interwood has established itself as a reliable OEM supplier for buyers in the USA, UK, Europe, Australia, and Asia.

Its operations balance volume capability with strong quality control, making it suitable for established brands and mid-sized importers.

Interwood is particularly known for its engineering discipline and ability to meet Western compliance standards.

Key Features:

- Modern factory with CNC machining and automated production lines

- Strong quality control and engineering-led manufacturing

- Certifications supporting ethical sourcing and compliance

- Experience serving Western retail and wholesale markets

Product Range:

- Dining room furniture (tables, chairs, cabinets)

- Living room furniture (TV units, storage, occasional tables)

- Bedroom furniture (beds, wardrobes, dressers, nightstands)

- Solid wood and veneer furniture in oak, acacia, pine, and mixed materials

Customization Capabilities:

- OEM manufacturing based on client designs and specifications

- Structural and finish optimization for manufacturability

- Support for custom dimensions, finishes, and material selections

- Ability to manage both repeat programs and project-based orders

MOQ: Interwood does not publicly publish fixed MOQs. In practice, buyers should expect container-level orders, typically translating to approximately 50–100 units per design, depending on size and complexity. MOQs may be negotiable for first orders or development programs, but Interwood is not positioned for very small batch production.

Lead Times: Standard production lead times are typically 45–60 days after order confirmation. First-time or fully custom orders may take slightly longer due to sampling and approvals, while repeat orders are often completed more efficiently once specifications are locked.

3. Q-Furniture

Q-Furniture is a Vietnam-based manufacturer specializing in concrete furniture and concrete–wood hybrid designs.

Founded by a team with architectural and design backgrounds, the company has carved out a niche in modern, design-driven furniture for both indoor and outdoor use.

Q-Furniture is known for combining industrial concrete aesthetics with functional, export-ready construction.

Its products are supplied to clients in the USA, Europe, Australia, and other design-focused markets.

Compared to traditional wood furniture factories, Q-Furniture offers greater flexibility for smaller production runs and custom projects.

Key Features:

- Specialization in fiber-reinforced concrete furniture

- Strong design-led approach rooted in architecture and interiors

- Products tested for durability and structural performance

- Suitable for boutique brands, hospitality, and design projects

Product Range:

- Concrete coffee tables, dining tables, benches, and stools

- Outdoor concrete furniture and planters

- Concrete sinks, basins, wall panels, and decorative elements

- Hybrid concrete, wood furniture combining warmth with durability

Customization Capabilities:

- ODM and OEM services for both existing and custom designs

- Custom sizes, finishes, pigments, and surface textures

- Ability to incorporate logos, branding, or bespoke detailing

- Well-suited for low-volume custom and project-based orders

MOQ: Q-Furniture is relatively low-MOQ friendly compared to most furniture manufacturers. Depending on the item, MOQs commonly fall in the 10–50 pieces per design range. Smaller quantities may be possible for samples or development runs, making Q-Furniture a practical option for SMEs and design-led brands.

Lead Times: Typical production lead times range from 40–60 days, depending on design complexity and order size. Sample development is often completed within 10–14 days, followed by full production. Concrete curing and finishing are factored into timelines, resulting in consistent delivery schedules.

4. AA Corporation

AA Corporation is Vietnam’s largest interior fit-out and custom furniture manufacturer, serving the global hospitality and luxury residential sectors since 1989.

The company provides turnkey interior solutions for high-end hotels, resorts, retail spaces, and premium residences worldwide.

With multiple factories in Vietnam and an international office network, AA Corporation operates at a scale few manufacturers can match.

Its reputation is built on craftsmanship, project management expertise, and the ability to deliver complex, fully customized interiors.

AA is best suited for large, design-driven projects rather than standard wholesale furniture sourcing.

Key Features:

- Full-service interior fit-out and custom manufacturing

- Extensive experience with luxury hospitality projects

- ISO-certified quality and environmental management systems

- Large workforce and multi-factory production capacity

Product Range:

- Custom hotel and hospitality furniture

- Lobby, lounge, restaurant, and spa furnishings

- High-end residential furniture and built-in cabinetry

- Architectural joinery, wall paneling, doors, and millwork

Customization Capabilities:

- Fully bespoke manufacturing based on architectural designs

- In-house engineering, carving, veneering, and upholstery

- Dedicated project management from design to installation

- Value engineering to balance aesthetics, cost, and durability

MOQ: AA Corporation operates on a project-based model rather than fixed MOQs. Orders are typically large in value and scope, such as full hotel or multi-unit residential projects. While individual custom pieces can be produced as part of a larger contract, AA is not suitable for small wholesale or ecommerce-oriented orders.

Lead Times: Lead times vary significantly by project size and complexity. Smaller custom furniture batches may require 10–12 weeks, while full hospitality fit-outs often span 3–6 months or longer. Timelines are agreed on a project basis, and AA is known for meeting delivery schedules tied to hotel openings and large-scale launches.

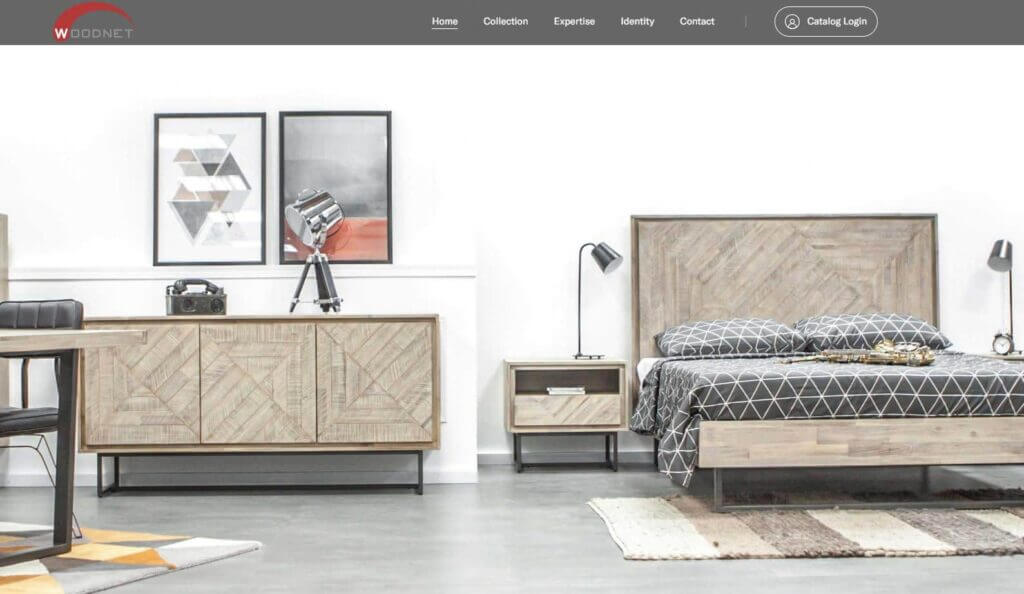

5. WOODNET

Woodnet is a Vietnam-based indoor furniture manufacturer founded in 2006 and built as a fully export-oriented business.

The company supplies wood and mixed-material home furniture to buyers across the US, Europe, and other international markets.

Woodnet is known for strong product development output and a wide catalog of collections in modern, Scandinavian, and mid-century styles.

Compared to many large factories, it is also considered more approachable for small-to-medium buyers who want to mix several SKUs in one shipment.

If your goal is to build a varied product line without committing to massive quantities per model, Woodnet is one of the more practical options in Vietnam.

Key Features:

- Export-focused operations with experience serving US/EU buyers

- Strong in-house product development and frequent new designs

- Buyer-friendly ordering model for mixed-SKU containers

- Broad catalog of indoor furniture across multiple styles

Product Range:

- Bedroom: beds, nightstands, dressers, wardrobes

- Living room: coffee tables, TV units, cabinets, upholstered seating

- Dining: dining tables, chairs, sideboards

- Casegoods and storage: bookcases, consoles, shelving

- Mixed materials: wood + metal, wood + rattan inserts, varied finishes

Customization Capabilities:

- OEM manufacturing based on client designs and specifications

- Modifications to dimensions, hardware, finishes, and materials

- Sample development support for new models

- Scales well from trial orders to repeat container programs

MOQ: Woodnet is often described as more flexible than high-volume giants. Reported starting points are around ~20 pieces per item/design, allowing buyers to mix multiple SKUs within a container rather than committing to one model at scale. Exact minimums may vary by product type and finish.

Lead Times: Most indoor furniture programs run around 45–60 days after specs and finishes are confirmed. Repeat orders of existing models often land closer to ~6 weeks, while first-time/customized designs typically take closer to ~8 weeks due to sampling and approvals.

6. FURAKA

Furaka is a Vietnam-based furniture manufacturer focused on solid wood furniture made primarily from acacia and rubberwood.

The brand began scaling into export markets in recent years and positions itself around durability, consistent craftsmanship, and value-driven pricing.

Furaka’s catalog spans indoor furniture as well as select outdoor ranges, making it a versatile option for buyers who want cohesive wood collections.

Compared to larger export giants, Furaka tends to be more open to smaller programs and mixed orders, which can be a better fit for SMEs.

It is a strong candidate if you want practical, saleable designs and a supplier that is still hungry for long-term partnerships.

Key Features:

- Solid wood focus (acacia and rubberwood) with value-oriented pricing

- Emphasis on durability and structural testing

- Clean, functional designs suited to mainstream markets

- More approachable for SMEs vs. mega-factories

Product Range

- Living room: side tables, coffee tables, TV units, shelving

- Bedroom: beds, nightstands, dressers, wardrobes

- Dining: tables, chairs, benches, bar stools

- Outdoor: acacia patio sets, benches, loungers, picnic tables

- Small wood accessories (varies by catalog)

Customization Capabilities:

- OEM projects based on buyer specs or drawings

- Finish options (stain/lacquer) and packaging/branding support

- Ability to develop prototypes for new models

- Flexible production approach for mixed-SKU programs

MOQ: Furaka does not clearly publish fixed MOQs. In practice, many SME-friendly wood factories operate around ~30–50 pieces per model, with the ability to mix items to reach a container target. Final MOQ typically depends on item size, complexity, and whether tooling/sampling is required.

Lead Times: Typical production lead times are around 50–60 days after order confirmation and material readiness. Smaller programs can sometimes move faster depending on factory scheduling, while mixed orders and new-development items may require the full ~8 weeks.

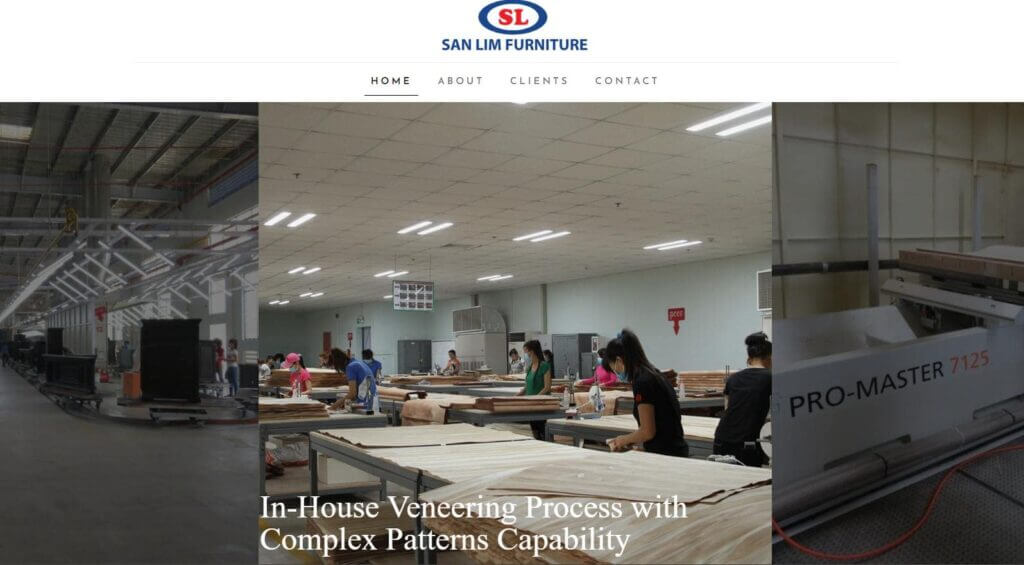

7. SAN LIM FURNITURE

San Lim Furniture is one of Vietnam’s largest wood furniture manufacturers, built for high-volume export production.

Founded in 2002 and based in Dong Nai, the company is widely associated with large-scale manufacturing programs for major international buyers.

San Lim’s operations are designed around efficiency, modern machinery, and repeat supply at scale, making it a strong fit for established importers and big retail programs.

The company also invests heavily in process improvement and production technology, helping maintain consistency across large batches.

If you need stable capacity and predictable output, San Lim is a serious contender, but it is generally not positioned for small trial orders.

Key Features:

- High-capacity production geared for large export programs

- Significant investment in machinery and finishing technology

- Strong process culture focused on continuous improvement

- Built for consistency across large-volume batches

Product Range:

- Indoor furniture: bedroom, dining, living room collections

- Casegoods and storage items

- Potential capability across related wood products (varies by program)

- Upholstered categories may be available depending on the manufacturing line

Customization Capabilities:

- OEM manufacturing at scale based on client specs

- Engineering support to optimize designs for mass production

- Product development support for finishes/construction (project-dependent)

- Strong supply chain coordination for large programs

MOQ: San Lim is typically container-focused and best suited for high-volume buyers. MOQs are usually structured around full-container production runs, and per-model minimums may be high depending on the product type. For most SMEs, this supplier makes sense only if you are ready for repeat container purchasing.

Lead Times: Large manufacturers typically operate with scheduled production queues. A practical expectation is ~60–75 days for new orders depending on seasonality, raw material readiness, and production allocation. Repeat programs can become more predictable once schedules and materials are standardized.

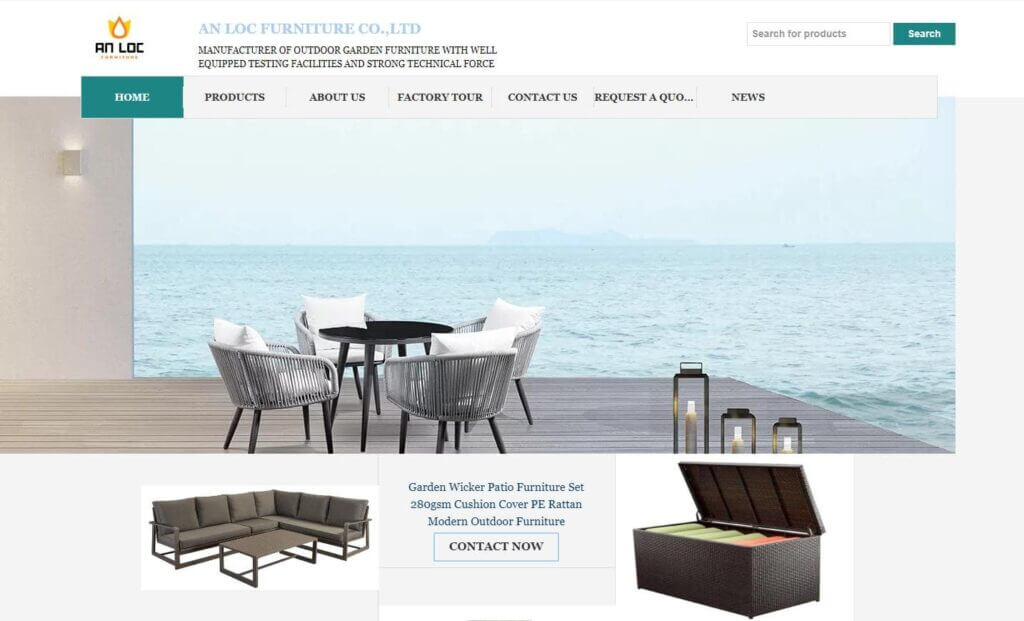

8. AN LOC FURNITURE

An Lộc Furniture is a Vietnam-based outdoor furniture manufacturer specializing in synthetic wicker, rattan-style weaves, and rope furniture over metal frames.

Established in 2001 and operating from Quy Nhơn (a known outdoor furniture hub), An Lộc supplies patio and hospitality buyers across the US, Europe, Australia, and other export markets.

The company’s strength is coordinated outdoor sets, lounge, dining, swings, and poolside pieces, built to look premium while holding up in real outdoor use.

An Lộc also positions itself as a responsive exporter, with a strong emphasis on design support and customer communication.

For SMEs selling outdoor sets (especially hospitality-style collections), this is one of the more relevant Vietnam-based options.

Key Features:

- Specialization in wicker/rattan-style and rope outdoor furniture

- Strong focus on complete outdoor sets for homes and hospitality

- UV/weather-resistant materials and rust-resistant frames

- Export experience across multiple international markets

Product Range:

- Outdoor lounge sets: sofas, armchairs, coffee tables

- Outdoor dining sets: tables + chairs (various seat counts)

- Hanging and swing chairs (egg chairs, hammock chairs)

- Poolside furniture: chaise lounges, daybeds, sun loungers

- Complementary items: umbrellas, storage, planters (varies by line)

Customization Capabilities:

- Custom weave patterns, frame shapes, and cushion configurations

- Choice of wicker color, fabric options, and frame finishes

- Private label production for brands and hospitality buyers

- Design collaboration to adapt models to climate/use-case needs

MOQ: Outdoor set suppliers typically work on container-based orders but allow mixed models. A common structure is a minimum number of sets per design plus a total order volume that makes a container economical. An Lộc appears open to mixed-SKU orders, which can be helpful for SMEs building a seasonal assortment.

Lead Times: Hand-woven outdoor furniture usually falls in a 45–70 day production window depending on weave complexity and order size. Simpler sets may land closer to ~6 weeks, while mixed orders and complex weaving can stretch to 8–10 weeks. Expect production schedules to be confirmed after sampling and material selection.

9. ARTEX NAM AN

Artex Nam An is a Vietnam-based manufacturer and exporter focused on handcrafted home décor and small furniture made from natural materials.

Founded in 2013, it operates through a large nationwide network of artisan groups and small workshops rather than a single mass-production factory.

This model allows Artex Nam An to offer a wide variety of woven designs using materials like seagrass, water hyacinth, bamboo, rattan, jute, and other renewable fibers.

The company exports globally and is best suited for buyers looking for eco-friendly décor collections with a handmade story.

For SMEs building a natural-home brand (or selling home accessories online), Artex Nam An is a strong fit due to its breadth of SKUs and relatively accessible ordering structure.

Key Features:

- Eco-friendly product focus (natural fibers, low-plastic positioning)

- Large artisan network enables variety and scalable handmade output

- Export experience + structured quality control despite decentralized production

- Good option for brands selling “natural,” “organic,” or “handmade” home collections

Product Range:

- Baskets, hampers, trays, and woven storage

- Small furniture: stools, poufs, plant stands, occasional pieces

- Home décor: placemats, wall décor, mirrors, lampshades, seasonal décor

- Materials: seagrass, water hyacinth, bamboo, rattan, palm leaf, jute, corn husk, recycled textiles

Customization Capabilities:

- Custom sizes, patterns, and shapes for handmade designs

- Color and dye options (often with AZO-free / safer dye positioning)

- Private labeling: tags, labels, and packaging customization

- SKU bundling and set-building (nested sets, coordinated collections)

- Support for documentation/testing needs depending on buyer requirements

MOQ: Artex Nam An publishes relatively buyer-friendly minimums for wholesale ordering. Reported starting points are ~50 pieces per design, with additional order rules such as a minimum total order value (e.g., around $2,000) and a minimum value per item type. This model works well for SMEs that want to mix many SKUs while still meeting practical production economics.

Lead Times: Production is typically made-to-order, with lead times commonly falling in the 40–70 day range depending on SKU count, complexity, and seasonal material availability. New/custom designs may require extra time for sampling and approvals (often an additional 1–2 weeks before production starts).

10. THINH PHU Furniture

Thịnh Phú Furniture is a Vietnam-based manufacturer focused on outdoor wood furniture, operating from Quy Nhơn, one of the country’s major outdoor furniture hubs.

The company uses woods like acacia and eucalyptus, offering a practical alternative to teak for buyers who want solid wood outdoor collections at more accessible price points.

Thịnh Phú is medium-scale and export-oriented, which can be a good balance for small-to-mid buyers who need reliability without dealing with mega-factories.

The brand also emphasizes structured production workflows, publishing different lead times for first-time versus repeat customers.

If you are sourcing outdoor wood furniture for ecommerce or wholesale, this supplier is positioned as a straightforward, export-ready option.

Key Features:

- Outdoor wood specialization with export experience

- Uses acacia/eucalyptus (often positioned as teak alternatives)

- Credibility signals through industry associations and FSC sourcing options

- Clear production workflow with defined lead time expectations

Product Range:

- Outdoor dining sets, bistro sets, picnic tables

- Lounge chairs, benches, outdoor sofas, sun loungers

- Outdoor tables: side tables, coffee tables, dining tables

- Outdoor accessories: planters, trolleys, deck tiles (varies by program)

- Finish options: oil finishes and painted/stained options depending on buyer needs

Customization Capabilities:

- OEM production based on drawings/specs

- Custom dimensions and structural tweaks for sets

- Finish color matching (stain/paint) and basic private labeling

- Mix-and-match set building (e.g., pairing chairs with different tables)

MOQ: Thịnh Phú typically targets wholesale export volumes. Reported minimums are around ~100 units per model for new orders, which generally aligns with container-based purchasing. Mixed orders may be possible, but buyers should expect meaningful quantities per SKU to keep production efficient.

Lead Times: Published production timelines are around ~60 days for new customers and approximately ~55 days for returning customers, which is consistent with outdoor wood furniture cycles. Lead time includes wood processing, finishing, drying time, assembly, and packing.

11. ATC FURNITURE

ATC Furniture (ATC Craft) is a Vietnam-based exporter specializing in synthetic rattan (wicker) furniture for outdoor and hospitality use.

Founded in 2006, the company supplies buyers globally and has built a reputation for woven furniture that balances design with commercial-grade durability.

ATC is a strong option for SMEs and mid-sized importers that need consistent export capability, quality systems, and a supplier that can handle both catalog orders and customization.

The company is also experienced in project-based supply for cafes, hotels, and restaurant spaces, useful if your brand targets hospitality buyers or outdoor lifestyle collections.

If you are building an outdoor furniture assortment with strong visual appeal, ATC is one of the more established Vietnam options.

Key Features:

- Synthetic wicker expertise (outdoor and hospitality positioning)

- ISO quality/environment certifications (strong process credibility)

- Global export experience + structured packing/logistics

- Proven ability to handle commercial and project-based requirements

Product Range:

- Outdoor wicker lounge sets and modular seating

- Dining sets, sun loungers, daybeds

- Hanging chairs, swing chairs, hammocks

- Indoor woven accent pieces (select categories)

- Materials: aluminum/steel frames, HDPE rattan, ropes/weaves, cushion fabrics (standard or upgraded)

Customization Capabilities:

- OEM/ODM support for hospitality and private-label buyers

- Custom weave styles, colors, frame finishes, and cushion fabric selection

- Branding options: tags, labels, and project-specific colorways

- Packaging configuration: KD vs assembled, manuals/inserts where needed

- Development support for custom pieces and rollout collections

MOQ: ATC generally works on container-based export orders, with flexibility to mix SKUs inside the container. Per-design minimums often depend on the item size (for example, a few sets per design for bulky sofa sets). They are typically more flexible than mega-factories, especially for first orders, as long as the overall order volume supports export shipping economics.

Lead Times: A common production window is ~45–60 days, influenced by weaving complexity and order size. Seasonal demand can extend timelines, so buyers ordering ahead of summer should plan early. ATC’s structured processes and export experience usually translate into predictable schedules once specifications are confirmed.

12. KAISER 1 FURNITURE INDUSTRY (VIETNAM) CO., LTD.

Kaiser 1 Furniture is a very large, foreign-invested furniture manufacturer in Vietnam, known for high-volume production of wooden home furniture, particularly in styles and specifications commonly required by North American buyers.

Established in 2004, the company operates at a scale comparable to the largest factories in the region, with extensive production space, a large workforce, and advanced machinery.

Kaiser also stands out for its compliance infrastructure, including internal testing capability and systems built to meet US standards (e.g., formaldehyde regulations and safety requirements).

This is a supplier designed for major retail programs and large distributors rather than small trial orders. For SMEs, Kaiser typically only makes sense if you are scaling quickly and already planning container-level purchasing.

Key Features:

- Mega-scale production built for high-volume retail programs

- Strong compliance and testing infrastructure (US-focused standards)

- FSC sourcing and systems aligned with regulated export markets

- Advanced machinery supporting consistency at scale

Product Range:

- Bedroom furniture sets: beds, nightstands, dressers, chests, armoires

- Dining furniture: dining tables, chairs, sideboards, cabinets

- Living room casegoods: TV units, coffee tables, display cabinets

- Veneer + engineered wood structures with controlled finishes and hardware

Customization Capabilities:

- OEM onboarding for large collections and retail programs

- Engineering support to refine designs for cost, quality, and compliance

- Finish matching and testing (useful for multi-SKU collections)

- Packaging and shipping optimization for large furniture programs (KD/RTA where needed)

MOQ: Kaiser 1 is structured for high-volume manufacturing, usually requiring container-level quantities. Per-SKU minimums are typically substantial (often 100+ units per item depending on size and complexity), and total orders may span multiple containers. This supplier is best for large distributors, big-box supply programs, and buyers with predictable reorder volume.

Lead Times: Lead times are commonly in the ~55–60 day range once samples/specs are approved, with repeat programs becoming more predictable when production slots are reserved. Large buyers often plan forecasts in advance to secure capacity, which helps Kaiser maintain consistent delivery windows.

13. Rochdale Spears

Rochdale Spears is a Vietnam-based furniture manufacturer operating since 2003, known for premium, design-forward home furniture made for export markets.

The company is recognized for handling complex finishes and mixed-material detailing, often the kind of work that standard “catalog factories” avoid.

Its product development strength typically appeals to luxury retailers and designer-led brands in North America and Europe.

Rochdale Spears is best suited for buyers who care about craftsmanship, materials, and finish execution, not just price.

For SMEs, it is a stronger match if you are building a premium collection and can support mid-to-high order volumes.

Key Features:

- Premium positioning with complex finishes and mixed materials

- Strong capability across both casegoods and upholstered categories

- Experienced export supplier for North America and Europe

- Suitable for coordinated “collection” production (multi-SKU lifestyle lines)

Product Range:

- Upholstery: sofas, armchairs, occasional chairs, upholstered beds

- Casegoods: coffee/side tables, cabinets, consoles, dining tables, sideboards

- Décor categories may include mirrors and select lighting/accessories depending on program

- Mixed-material executions (wood + metal, specialty veneers, decorative finishes)

Customization Capabilities:

- OEM/ODM collaboration for designer and retail collections

- Finish matching (stain, paint, distressing, sheen level, antiquing)

- Upholstery customization (fabric/leather selection, cushion specs)

- Custom hardware, inlays, and decorative detailing for higher-end lines

- Ability to support limited-run launches that scale into repeat programs

MOQ: Rochdale Spears is generally not a low-MOQ supplier, but MOQs can vary depending on product value and complexity. For premium casegoods and upholstery, buyers often start with small-to-mid production batches per SKU and scale after validation. In practice, you should expect MOQs that support efficient production (often dozens per item rather than single digits), and many programs are planned around container-level shipping.

Lead Times: Lead times typically run 60–90 days after final sample/spec approval, depending on the complexity of materials, finishing steps, and any special component sourcing. Established/repeat SKUs can move faster, while first-time designs often require additional development and QC time. For premium collections, planning 8–12 weeks for production is a realistic baseline before ocean transit.

14. Truong Thanh Furniture Corporation (TTF)

Truong Thanh Furniture (TTF) is one of Vietnam’s best-known furniture corporations, founded in 1993 and operating at a large export scale.

The company is often associated with strong supply-chain control, including upstream capabilities tied to timber sourcing and processing.

TTF manufactures across multiple furniture categories, home, office, and select outdoor, making it a viable option for buyers who want a broad product scope under one supplier group.

It is best suited for importers, retailers, and project buyers who need consistent production capacity and dependable delivery planning.

For SMEs, TTF becomes relevant when you are ready to move beyond small batches and into repeat container programs.

Key Features:

- Large-scale, export-ready operations with multi-category production

- Strong control over timber sourcing and processing (traceability advantage)

- Suitable for multi-container and ongoing supply programs

- Experience across home + office categories (useful for broad assortments)

Product Range:

- Indoor home furniture: bedroom, dining, living room casegoods

- Office furniture: desks, workstations, conference tables, storage systems

- Outdoor furniture: select wood outdoor ranges (project/program dependent)

- Project supply may include built-ins or related fixtures depending on scope

Customization Capabilities:

- OEM production for brands and large buyers

- Engineering support for knock-down/RTA designs and cost optimization

- Ability to run large, consistent programs across many SKUs

- Adaptation to different compliance and market standards (varies by category)

MOQ: TTF is typically structured around mid-to-large order volumes, often aligned with container-level purchasing. MOQs are generally set per model/style to keep production efficient (commonly 100+ units per SKU depending on item type), with flexibility improving when buyers consolidate multiple categories into larger total volume.

Lead Times: Standard lead times are usually around ~60 days for production after order confirmation, with larger orders often shipped in phases (multiple containers released on a rolling schedule). Complex custom programs or very high-volume orders may extend closer to 75–90 days, but the advantage of a larger supplier is more predictable planning once production slots are secured.

15. Savimex Corporation

Savimex Corporation is a Vietnam-based indoor furniture manufacturer with over 35 years of experience, making it one of the country’s most established yet SME-accessible exporters.

Founded in 1985 and headquartered in Ho Chi Minh City, Savimex specializes in wooden indoor furniture for residential and light commercial use.

Unlike mega-factories focused solely on mass retail, Savimex balances volume capability with flexibility, serving mid-sized furniture brands, importers, and distributors across the USA, EU, and Japan.

The company operates multiple production facilities and is known for its strong wood processing expertise, especially in kiln-dried solid wood and veneer furniture.

Savimex is often chosen by buyers who want stable quality, export compliance, and manageable MOQs without dealing with ultra-large factories.

Key Features:

- Works with mid-sized brands and wholesalers, not just big-box retailers

- Strong in kiln drying, machining, and finishing consistency

- Long-standing exporter to the USA, EU, and Japan

- FSC, ISO 9001, BSCI (varies by factory)

Product Range:

- Indoor wooden furniture (bedroom, dining, living room)

- Dining tables, chairs, cabinets, TV stands

- Bedroom furniture (beds, nightstands, wardrobes)

- Veneer and solid wood furniture collections

Customization Capabilities:

- OEM manufacturing based on buyer designs

- Custom dimensions, finishes, and wood species

- Finish matching for repeat collections

- Private label packaging and labeling

MOQ: Savimex does not publish fixed MOQs publicly, but in practice, MOQs are generally lower than mega-factories. Buyers can expect ~50–100 units per model depending on complexity, with mixed SKUs allowed to fill a container. This makes Savimex workable for growing brands launching collections rather than single SKUs.

Lead Times: Standard production lead time is typically 45–60 days after sample approval. Repeat orders are often faster once finishes and constructions are locked. Savimex’s internal wood processing helps reduce raw material delays, making lead times relatively stable for SME buyers.

16. Minh Duong Furniture

Minh Duong Furniture is a Vietnam-based indoor furniture manufacturer focused on solid wood and veneer home furniture for export markets.

Operating out of southern Vietnam, the company is frequently listed on Alibaba (Vietnam suppliers) and works primarily with small to medium international buyers.

Minh Duong positions itself between artisan workshops and large factories, offering reliable export production without excessive volume requirements.

The company supplies buyers in the USA, Europe, and Australia, particularly those sourcing dining and bedroom furniture.

Its appeal lies in competitive pricing, straightforward communication, and flexible order structures.

Key Features:

- Actively works with smaller importers and ecommerce brands

- Lower overhead compared to large corporate manufacturers

- Familiar with international packaging and compliance requirements

- Visible transaction history and export focus

Product Range:

- Dining tables and chairs

- Bedroom furniture (beds, nightstands, dressers)

- Living room cabinets and sideboards

- Solid wood and veneer furniture (rubberwood, acacia, oak veneer)

Customization Capabilities:

- OEM production from drawings or reference samples

- Custom stains, paint colors, and finishes

- Minor structural adjustments for cost or packaging optimization

- Private label branding for cartons and manuals

MOQ:

Minh Duong is notably flexible compared to larger factories. Typical MOQs range from 30–80 units per model, depending on size and finish. Buyers can usually mix multiple SKUs within one container, making it suitable for testing new collections.

Lead Times:

Production lead time generally ranges from 40–55 days. Simpler items may be completed faster, while new designs or complex finishes push timelines toward the higher end. Sampling usually takes 10–15 days.

17. Viet Anh Furniture

Viet Anh Furniture is a Vietnamese OEM furniture manufacturer specializing in indoor wooden furniture for export, particularly for mid-sized brands and distributors.

The company operates as a practical, production-focused supplier rather than a design-heavy luxury manufacturer.

Viet Anh is often sourced via Alibaba and Global Sources, where it markets itself as a reliable OEM partner for dining, bedroom, and living room furniture.

Buyers working with Viet Anh typically value clear pricing, reasonable MOQs, and consistent output rather than ultra-premium finishes.

Key Features:

- Built around buyer-led designs

- Lower entry barrier than major exporters

- Designs optimized for production efficiency

- Familiar with US and EU buyer requirements

Product Range:

- Dining furniture (tables, chairs, benches)

- Bedroom furniture (beds, nightstands, wardrobes)

- Living room cabinets and storage units

- Knock-down and flat-pack friendly designs

Customization Capabilities:

- OEM manufacturing from CAD or reference designs

- Finish customization (stains, paints, veneers)

- Packaging optimization for container efficiency

- Logo printing and private labeling

MOQ:

Viet Anh typically works with MOQs starting around 50 units per SKU, with flexibility for mixed-model container orders. This makes them accessible for small to mid-sized brands scaling beyond trial orders.

Lead Times:Lead times usually fall between 45–60 days, depending on order volume and complexity. Repeat orders benefit from faster turnaround once materials and finishes are standardized.

What Kind of Furniture is Made in Vietnam?

Vietnam is known for producing a diverse range of furniture – from affordable bulk products to high-end, handcrafted pieces for global retailers and hospitality brands.

The country’s manufacturing strength lies in its skilled labor, access to quality raw materials, and well-developed export infrastructure.

Here’s a quick overview of the main categories:

- Indoor Wooden Furniture: Includes beds, dining tables, chairs, cabinets, wardrobes, and home office furniture. These are often made from acacia, rubberwood, eucalyptus, teak, and engineered woods.

- Outdoor Furniture: A major export category. Vietnam produces durable outdoor sets using wood, synthetic rattan, aluminum, and concrete, often treated for weather resistance.

- Wicker and Rattan Furniture: Vietnam is a global hub for hand-woven products made from natural fibers like rattan, water hyacinth, bamboo, and seagrass, used for furniture, décor, and baskets.

- Upholstered and Mixed-Material Furniture: Many manufacturers offer sofas, lounge chairs, and upholstered beds using a mix of textiles, wood, and metal, blending traditional craftsmanship with modern trends.

- Contract and Custom Furniture: Vietnam also supports hotel, resort, and office fit-outs, offering tailored furniture solutions for commercial projects through OEM/ODM services.

Should You Source Furniture From Vietnam or China?

Both Vietnam and China are global leaders in furniture manufacturing, but which one is right for your business depends on your priorities. Here’s a comparison to help guide your decision:

Vietnam: Strengths

Cost-effective for solid wood and natural fiber furniture: Vietnam has abundant access to acacia, rubberwood, bamboo, and rattan, making it ideal for indoor and outdoor wood-based furniture.

Skilled craftsmanship for handwoven and detailed work: Traditional weaving and woodworking skills allow for more artisanal designs.

Lower tariffs for U.S. buyers: Compared to China, furniture from Vietnam typically faces fewer trade restrictions and lower import duties in Western markets.

Strong export infrastructure: Many Vietnamese factories are export-ready, with international certifications and English-speaking sales teams.

China: Strengths

Better suited for high-volume, mechanized production: China has a wider network of fully automated factories and supply chains for mass production.

Wider variety of materials and designs: From budget particle board furniture to luxury metal-accented pieces, China offers greater product range diversity.

More mature logistics and fulfillment services: Faster turnaround for large orders, more established fulfillment hubs, and deeper supply networks.

So, Which Should You Choose?

If you need custom wood, rattan, or outdoor furniture at reasonable MOQs with good craftsmanship, Vietnam is a strong option for many buyers.

If you’re looking for ultra-scalable production, more diverse material options, or streamlined supply chains, China remains the best fit, especially for growing eCommerce brands.

Looking to source furniture from China?

At NicheSources, we help global businesses source high-quality furniture directly from trusted Chinese suppliers, with full support for product development, quality control, and shipping.

Contact us today to get started with a reliable sourcing partner.

Frequently Asked Questions

How Can I Find the Top Furniture Manufacturers in Vietnam?

You can find top furniture manufacturers in Vietnam through various methods. Industry trade shows and exhibitions are excellent places to connect with manufacturers directly. Online platforms and B2B marketplaces also list many Vietnamese furniture producers.

The Vietnam Furniture Association provides a directory of its members. You can also work with a reputable sourcing agent like us who specializes in Vietnamese furniture.

What Are the Distinctive Qualities of Furniture Made in Vietnam?

Vietnamese furniture is known for several distinctive qualities:

- Craftsmanship: Many pieces feature intricate hand-carved details.

- Materials: High-quality local woods like acacia and rubberwood are commonly used.

- Design: A blend of traditional Asian and modern Western styles is often seen.

French-style and handmade furniture are particular strengths of some Vietnamese manufacturers. The industry also emphasizes sustainability and eco-friendly production methods.

Are There Any Well-Known Brands for Furniture Produced in Vietnam?

Vietnam has become a major hub for furniture production, attracting numerous global brands due to its competitive advantages in cost, craftsmanship, and large-scale production capacity. Here are some notable brands that manufacture furniture in Vietnam:

- Ashley Furniture: One of the world’s largest furniture manufacturers, Ashley sources various types of furniture from Vietnam, including wooden and upholstered products.

- Pottery Barn: As part of the Williams-Sonoma family, Pottery Barn produces a significant portion of its upscale home furnishings in Vietnam. This includes wooden furniture, upholstered items, and decorative accessories. However, they also source from other countries to maintain a diverse product line.

- Crate and Barrel: This popular retailer utilizes Vietnamese manufacturing for a wide range of its furniture offerings. Their production in Vietnam focuses on wood furniture and decorative accessories, allowing them to maintain high quality while keeping costs competitive. Like Pottery Barn, Crate and Barrel also sources from multiple countries.

- West Elm: Known for modern and sustainable furniture, West Elm partners with Vietnamese manufacturers for some of its product lines, emphasizing high-quality craftsmanship and sustainability.

- Restoration Hardware: This luxury brand relies on Vietnamese expertise for both wood and upholstered furniture, taking advantage of the country’s skilled labor force.

- IKEA: The Swedish furniture giant has increased its sourcing from Vietnam, particularly for wood-based furniture, as part of its strategy to diversify its manufacturing base.

- Ethan Allen: Known for high-quality furniture, Ethan Allen utilizes Vietnamese manufacturers for various pieces in its residential and office collections.

It’s important to note that while these brands produce furniture in Vietnam, they often have a global sourcing strategy. The exact origin of a specific piece can usually be found on the product label or by contacting the company directly.

What Types of Wood Are Predominantly Used by Furniture Makers in Vietnam?

Vietnamese furniture makers use a variety of wood types:

- Acacia: Fast-growing and sustainable, popular for outdoor furniture.

- Rubberwood: Durable and affordable, widely used for indoor furniture.

- Oak and ash: Imported woods used for higher-end pieces.

Local manufacturers also work with bamboo, rattan, and other sustainable materials. The use of eco-friendly and responsibly sourced wood is becoming increasingly important in the industry.